Re: House selling prices

Posted: Thu Nov 09, 2023 10:07 am

I don’t understand foe workings, I won’t foe anyone, no point.Joe315 wrote: ↑Thu Nov 09, 2023 10:03 amYou are on foe Oiram. If someone quotes you I see it.

The Unofficial and Independent Leyton Orient Message Board

https://lofcforum.com/forum1/phpBB3/

I don’t understand foe workings, I won’t foe anyone, no point.Joe315 wrote: ↑Thu Nov 09, 2023 10:03 amYou are on foe Oiram. If someone quotes you I see it.

Joe315 wrote: ↑Thu Nov 09, 2023 10:05 amOiram sells car due to high mortgage in the 80s.Loin Cloth Lenny wrote: ↑Thu Oct 05, 2023 8:47 pm It went down to about 12% after about year or so as far as I can recall . Rates in the 70’s and early 80’s were always around 7% or more. Banks only offer fixed rates when they fancy the rates will go down. It was touch and go for ages when rates were 15%, my wages were not increasing and I had to sell my nice car to make ends meet.

Joe315 wrote: ↑Thu Nov 09, 2023 10:10 amJoe315 wrote: ↑Thu Nov 09, 2023 10:05 amOiram sells car due to high mortgage in the 80s.Loin Cloth Lenny wrote: ↑Thu Oct 05, 2023 8:47 pm It went down to about 12% after about year or so as far as I can recall . Rates in the 70’s and early 80’s were always around 7% or more. Banks only offer fixed rates when they fancy the rates will go down. It was touch and go for ages when rates were 15%, my wages were not increasing and I had to sell my nice car to make ends meet.

You have obviously suffered hardship. The roof above your head should be the financial priority. I had to sell my Porsche. Now worth at least 15 times what I sold it for but property has risen far greater by comparison and no regrets.

Sure that correlates? Helluva lot of Far Eastern 'investors' don't ever live in the place they buy so they're not part of any migration figures.Beradogs wrote: ↑Mon Mar 25, 2024 5:29 pm Shhhhhhhhhh.. you can’t say that!…Of course there is, I know at least 5 different Hong Kong Chinese families that have bought in the uk on new developments, spending a lot of money in the process. One development in the south east, 40% of all buyers are from HK.

Is he being sued by the buyer yet? I suspect we will find out when he comes on here begging for free advice again.Rich Tea Wellin wrote: ↑Wed Nov 20, 2024 1:25 pm LSN solely responsible for those transaction timescales?

It's all the Labour government's fault. They are a shambles.Dunners wrote: ↑Wed Nov 20, 2024 1:08 pm Far be it from me to drag up old threads just to prove I was right all along, but....

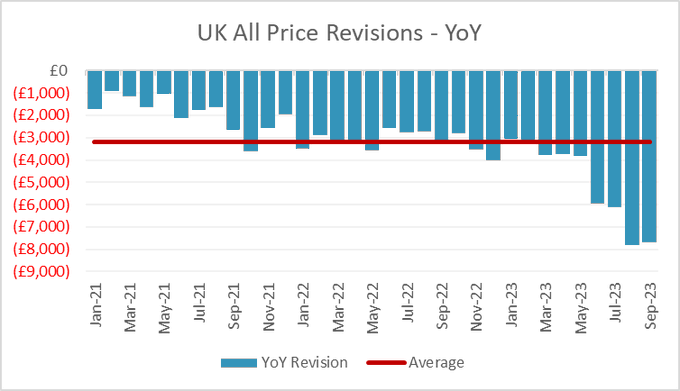

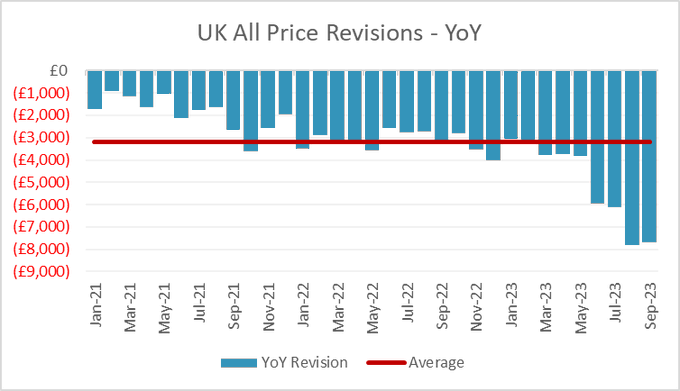

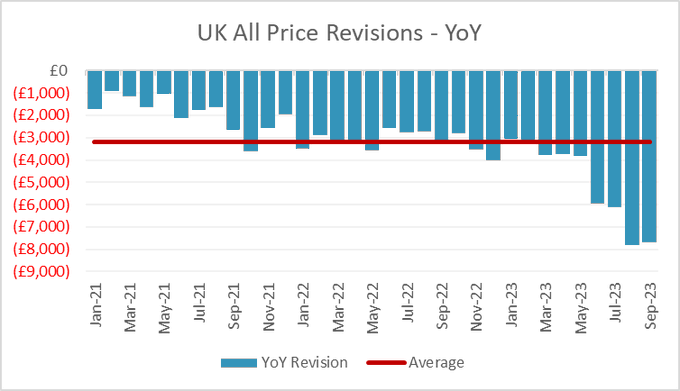

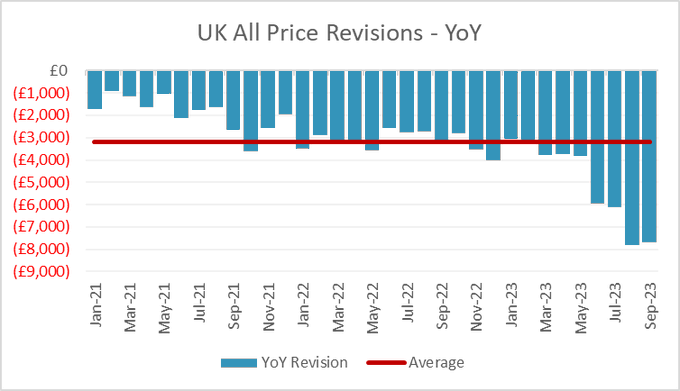

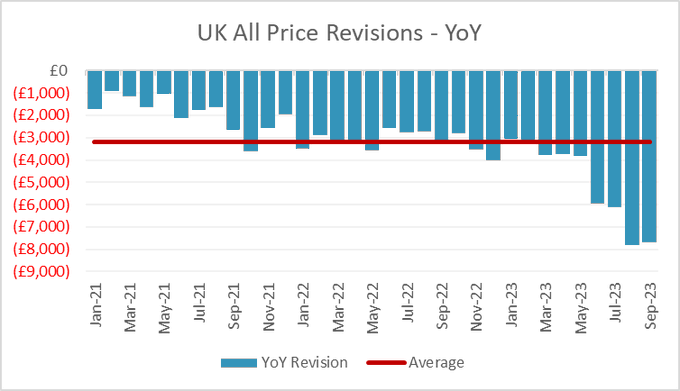

The ONS has just updated its house price data showing average UK prices in September 2023 (£283,680) were revised down by £7,705 (-2.6%) compared to the price originally reported a year ago (£291,385). They did the same last month too, so this is a big deal (although is not being reported widely in the media).

Due to transaction timescales, fixed mortgages, delays with Land Registry, misleading info from lenders and estate agents etc, it can be difficult to get a real sense of what is happening out there. We already knew that transactional volumes had crashed but, despite that, the evidence now makes it clear that prices are also sliding.

Eh? You’ve just sold yours haven’t you?

Have just completed a residential portfolio valuation for nearly 300 houses across the UK. More or less every agent (except a few happy clappies who'll never tell you things are quiet) were reporting a huge fall off in enquiries from buyers across the board with housing stock sticking around much longer than it was 12-24 months ago. Volume of transactions has fallen off a cliff and it was a struggle in certain areas to find much in the way of recent evidence to support valuation figures. Most put it down to borrowing costs and general economic / employment uncertainty - abortive sales figures look to be on the rise as well with sales agreed more recently tending to fall out of bed more regularly so Caca's probably had a result in pulling the wool over his buyer's eyes.Dunners wrote: ↑Wed Nov 20, 2024 1:08 pm Far be it from me to drag up old threads just to prove I was right all along, but....

The ONS has just updated its house price data showing average UK prices in September 2023 (£283,680) were revised down by £7,705 (-2.6%) compared to the price originally reported a year ago (£291,385). They did the same last month too, so this is a big deal (although is not being reported widely in the media).

Due to transaction timescales, fixed mortgages, delays with Land Registry, misleading info from lenders and estate agents etc, it can be difficult to get a real sense of what is happening out there. We already knew that transactional volumes had crashed but, despite that, the evidence now makes it clear that prices are also sliding.

The valuers I'm working with across our resi and commercial portfolio are reporting the same. Nationwide. The tin can that has been kicked down the road since 2008 may not have anywhere else to go.Admin wrote: ↑Wed Nov 20, 2024 2:56 pmHave just completed a residential portfolio valuation for nearly 300 houses across the UK. More or less every agent (except a few happy clappies who'll never tell you things are quiet) were reporting a huge fall off in enquiries from buyers across the board with housing stock sticking around much longer than it was 12-24 months ago. Volume of transactions has fallen off a cliff and it was a struggle in certain areas to find much in the way of recent evidence to support valuation figures. Most put it down to borrowing costs and general economic / employment uncertainty - abortive sales figures look to be on the rise as well with sales agreed more recently tending to fall out of bed more regularly so Caca's probably had a result in pulling the wool over his buyer's eyes.Dunners wrote: ↑Wed Nov 20, 2024 1:08 pm Far be it from me to drag up old threads just to prove I was right all along, but....

The ONS has just updated its house price data showing average UK prices in September 2023 (£283,680) were revised down by £7,705 (-2.6%) compared to the price originally reported a year ago (£291,385). They did the same last month too, so this is a big deal (although is not being reported widely in the media).

Due to transaction timescales, fixed mortgages, delays with Land Registry, misleading info from lenders and estate agents etc, it can be difficult to get a real sense of what is happening out there. We already knew that transactional volumes had crashed but, despite that, the evidence now makes it clear that prices are also sliding.

The commercial market isn't faring much better. We're seeing the business failure rate increase quarter by quarter, particularly in the retail sector where changes in shopping trends are massively impacting everyone. Take-up is really slow excepting industrial / warehouse space which tends to still shift fairly quickly, particularly if it's in Walthamstow where bearded hipsters are still drifting out of Hoxton.

Sinking funds are a huge issue or more correctly, the lack of them. Have turned away god knows how much block management work over the last 5 years as almost all of them were massively underfunded, in need of modernisation or refurbishment and occupied by leaseholders who were never going to be in a position to make up the shortfalls. Throw in the cladding issues that remain unresolved, it's a complete mess. If I was a lender I'd be absolutely sh*tting myself at how much of this is going to end up in their laps.Dunners wrote: ↑Wed Nov 20, 2024 3:47 pmThe valuers I'm working with across our resi and commercial portfolio are reporting the same. Nationwide. The tin can that has been kicked down the road since 2008 may not have anywhere else to go.Admin wrote: ↑Wed Nov 20, 2024 2:56 pmHave just completed a residential portfolio valuation for nearly 300 houses across the UK. More or less every agent (except a few happy clappies who'll never tell you things are quiet) were reporting a huge fall off in enquiries from buyers across the board with housing stock sticking around much longer than it was 12-24 months ago. Volume of transactions has fallen off a cliff and it was a struggle in certain areas to find much in the way of recent evidence to support valuation figures. Most put it down to borrowing costs and general economic / employment uncertainty - abortive sales figures look to be on the rise as well with sales agreed more recently tending to fall out of bed more regularly so Caca's probably had a result in pulling the wool over his buyer's eyes.Dunners wrote: ↑Wed Nov 20, 2024 1:08 pm Far be it from me to drag up old threads just to prove I was right all along, but....

The ONS has just updated its house price data showing average UK prices in September 2023 (£283,680) were revised down by £7,705 (-2.6%) compared to the price originally reported a year ago (£291,385). They did the same last month too, so this is a big deal (although is not being reported widely in the media).

Due to transaction timescales, fixed mortgages, delays with Land Registry, misleading info from lenders and estate agents etc, it can be difficult to get a real sense of what is happening out there. We already knew that transactional volumes had crashed but, despite that, the evidence now makes it clear that prices are also sliding.

The commercial market isn't faring much better. We're seeing the business failure rate increase quarter by quarter, particularly in the retail sector where changes in shopping trends are massively impacting everyone. Take-up is really slow excepting industrial / warehouse space which tends to still shift fairly quickly, particularly if it's in Walthamstow where bearded hipsters are still drifting out of Hoxton.

I'm currently in discussions with MHCLG officials, RICS and TPI, where we're looking at the issue of modern residential blocks' life-cycle projections and costs, and their inadequate sinking fund provisions.

We've done some assessments and estimate that 84% of blocks have insufficient reserves to cover the maintenance necessary just to achieve design life (usually 80 years for steel frame). Some resident profiling suggests that, in most cases, residents are unable to afford the level of meaningful increase in contributions to offset the risk of ruinous major work service charge demands. Which means that, the only other cost element that can give, is land values.

RICS have been doing some back-of-an-envelope calculations and think we could be looking at a 20% hit (possibly up to 40% in HRRBs). That could be across an estimated 4.5milion flats, with knock-on effects through rest of housing market.

Nothing confirmed as yet, but you may get some new guidance from RICS. Pennycook's team have hinted that Treasury is proper sh*tting it. We also think that someone has let slip to UK Finance, which is why the banks have all increased mortgage rates and held savings rates, despite the recent BOE reduction. Increasing their reserves while they can.

Ah yes, the cladding issue. That's also on the agenda of these discussions. The last government didn't want to set up any register because they knew that the number of buildings affected is so high, that just knowing that number would trigger an even bigger crisis with banks. Ignorance is indeed bliss.