House selling prices

Moderator: Long slender neck

-

Friend or faux

- Tiresome troll

- Posts: 1085

- Joined: Thu Apr 07, 2022 10:34 pm

- Has thanked: 218 times

- Been thanked: 186 times

Re: House selling prices

Dunners wrote: ↑Wed Sep 27, 2023 11:31 am

I reckon the youth of today should be made to re-enact the D-day landings, under live fire, before they can qualify for any mortgage product.

That'll teach 'em.

At last some sensible messaging on this Board. This could replace The Duke of Edinburgh Award Scheme.

I reckon the youth of today should be made to re-enact the D-day landings, under live fire, before they can qualify for any mortgage product.

That'll teach 'em.

At last some sensible messaging on this Board. This could replace The Duke of Edinburgh Award Scheme.

- Dunners

- Boardin' 24/7

- Posts: 9790

- Joined: Thu Apr 11, 2019 4:21 pm

- Has thanked: 1203 times

- Been thanked: 2694 times

Re: House selling prices

Here comes the crunch: www.theguardian.com/money/2023/sep/28/m ... sions-kpmg

"UK mortgage payers making big changes to meet higher payments, survey finds

Britons are raiding savings or cutting pension contributions, KPMG study finds"

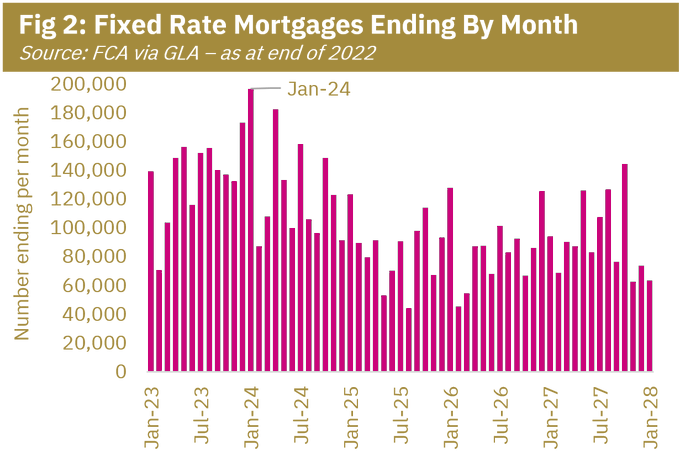

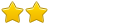

On average 100,000 households a month are coming off historically low fixed-interest mortgage deals, and being hit with much higher fixed rates (if they are lucky) or going onto standard variables. And for most of those households, their mortgage repayments will jump to a level that's equivilent to 27% of their income.

But this figure is an average. In this coming December and January, it'll be 360,000 households. Merry Christmas.

(Also, for those paying attention, this is one of the reasons why the Conservatives are going to double-down on "culture war" tactics in the run up to the next election)

"UK mortgage payers making big changes to meet higher payments, survey finds

Britons are raiding savings or cutting pension contributions, KPMG study finds"

On average 100,000 households a month are coming off historically low fixed-interest mortgage deals, and being hit with much higher fixed rates (if they are lucky) or going onto standard variables. And for most of those households, their mortgage repayments will jump to a level that's equivilent to 27% of their income.

But this figure is an average. In this coming December and January, it'll be 360,000 households. Merry Christmas.

(Also, for those paying attention, this is one of the reasons why the Conservatives are going to double-down on "culture war" tactics in the run up to the next election)

-

Give it to Jabo

- Bored office worker

- Posts: 2892

- Joined: Thu Apr 11, 2019 9:34 pm

- Has thanked: 109 times

- Been thanked: 455 times

Re: House selling prices

English - to Functional Skills and GCSE Levels. The learners are enrolled on vocational courses but have to study Maths/English. Almost all of them are "good sorts".Max B Gold wrote: ↑Wed Sep 27, 2023 9:56 amInteresting. What subject do you teach?Give it to Jabo wrote: ↑Tue Sep 26, 2023 12:36 pm Other side of the coin. I have started a job in a college and the topic of D Day came up. Precious few of the learners had a clue about this event. I thought about all those people who sacrificed their lives etc...

- Dunners

- Boardin' 24/7

- Posts: 9790

- Joined: Thu Apr 11, 2019 4:21 pm

- Has thanked: 1203 times

- Been thanked: 2694 times

Re: House selling prices

Finally, some common sense. The Housing Minister has confirmed at the Tory conference that Help to Buy is dead.

“If we incentivise through Help to Buy, First Homes, or any of these schemes, that’s great for those people, but it inflates the prices. Demand has to be balanced with the supply side.”

We're already beginning to see the financial destitution this ridiculous policy is having on households who purchased using HTB. It would be up there with the PPI scandal if it were not so heavily caveated through conveyancers.

“If we incentivise through Help to Buy, First Homes, or any of these schemes, that’s great for those people, but it inflates the prices. Demand has to be balanced with the supply side.”

We're already beginning to see the financial destitution this ridiculous policy is having on households who purchased using HTB. It would be up there with the PPI scandal if it were not so heavily caveated through conveyancers.

- Long slender neck

- MB Legend

- Posts: 15019

- Joined: Fri Apr 12, 2019 9:13 am

- Has thanked: 2652 times

- Been thanked: 3451 times

-

Daily Express bot

- Tiresome troll

- Posts: 1468

- Joined: Sun Aug 13, 2023 5:26 am

- Has thanked: 733 times

- Been thanked: 114 times

Re: House selling prices

I remember the 80’s when I was paying over 50% of my wages on my mortgage as interest rates were 15%.Long slender neck wrote: ↑Wed Oct 04, 2023 11:56 am Mortgage payments 27% of income- is that meant to be a high percentage?

- OyinbO

- Bored office worker

- Posts: 2306

- Joined: Thu Apr 11, 2019 3:28 pm

- Location: London

- Has thanked: 1551 times

- Been thanked: 778 times

Re: House selling prices

For how long?Loin Cloth Lenny wrote: ↑Thu Oct 05, 2023 6:55 amI remember the 80’s when I was paying over 50% of my wages on my mortgage as interest rates were 15%.Long slender neck wrote: ↑Wed Oct 04, 2023 11:56 am Mortgage payments 27% of income- is that meant to be a high percentage?

Wage inflation was much higher then too.

-

Daily Express bot

- Tiresome troll

- Posts: 1468

- Joined: Sun Aug 13, 2023 5:26 am

- Has thanked: 733 times

- Been thanked: 114 times

Re: House selling prices

It went down to about 12% after about year or so as far as I can recall . Rates in the 70’s and early 80’s were always around 7% or more. Banks only offer fixed rates when they fancy the rates will go down. It was touch and go for ages when rates were 15%, my wages were not increasing and I had to sell my nice car to make ends meet.

- OyinbO

- Bored office worker

- Posts: 2306

- Joined: Thu Apr 11, 2019 3:28 pm

- Location: London

- Has thanked: 1551 times

- Been thanked: 778 times

Re: House selling prices

The structure of the mortgage market has changed a great deal since the 80s. Fixed rates were very rare then, almost everyone was on the SVR, so there was no lag between base rate changes and the effect on mortgagors.

-

o-no

- Tiresome troll

- Posts: 1491

- Joined: Thu Apr 11, 2019 8:06 pm

- Has thanked: 164 times

- Been thanked: 455 times

Re: House selling prices

Princess Vanden Plas?Loin Cloth Lenny wrote: ↑Thu Oct 05, 2023 8:47 pm It went down to about 12% after about year or so as far as I can recall . Rates in the 70’s and early 80’s were always around 7% or more. Banks only offer fixed rates when they fancy the rates will go down. It was touch and go for ages when rates were 15%, my wages were not increasing and I had to sell my nice car to make ends meet.

-

Daily Express bot

- Tiresome troll

- Posts: 1468

- Joined: Sun Aug 13, 2023 5:26 am

- Has thanked: 733 times

- Been thanked: 114 times

Re: House selling prices

MGB Roadster, paid the loan for 4 or 5 months!o-no wrote: ↑Thu Oct 05, 2023 10:15 pmPrincess Vanden Plas?Loin Cloth Lenny wrote: ↑Thu Oct 05, 2023 8:47 pm It went down to about 12% after about year or so as far as I can recall . Rates in the 70’s and early 80’s were always around 7% or more. Banks only offer fixed rates when they fancy the rates will go down. It was touch and go for ages when rates were 15%, my wages were not increasing and I had to sell my nice car to make ends meet.

-

Daily Express bot

- Tiresome troll

- Posts: 1468

- Joined: Sun Aug 13, 2023 5:26 am

- Has thanked: 733 times

- Been thanked: 114 times

Re: House selling prices

Dunners wrote: ↑Thu Sep 28, 2023 8:59 am Here comes the crunch: www.theguardian.com/money/2023/sep/28/m ... sions-kpmg

"UK mortgage payers making big changes to meet higher payments, survey finds

Britons are raiding savings or cutting pension contributions, KPMG study finds"

On average 100,000 households a month are coming off historically low fixed-interest mortgage deals, and being hit with much higher fixed rates (if they are lucky) or going onto standard variables. And for most of those households, their mortgage repayments will jump to a level that's equivilent to 27% of their income.

But this figure is an average. In this coming December and January, it'll be 360,000 households. Merry Christmas.

(Also, for those paying attention, this is one of the reasons why the Conservatives are going to double-down on "culture war" tactics in the run up to the next election)

In the real World, most prudent borrowers made overpayments or put money aside with the historically low interest rates, ‘saving for a rainy day’. This way you are ahead of your mortgage .

- Dunners

- Boardin' 24/7

- Posts: 9790

- Joined: Thu Apr 11, 2019 4:21 pm

- Has thanked: 1203 times

- Been thanked: 2694 times

-

Adz

- Bored office worker

- Posts: 2747

- Joined: Fri Apr 12, 2019 10:15 am

- Has thanked: 114 times

- Been thanked: 654 times

Re: House selling prices

Pah, we're currently paying 50% of our COMBINED wage on our mortgage. You cant look at interest rates in isolation, they need to be compared in conjunction with house prices and wages. When you do that, the effect of current interest rates are worse than the 80s.Loin Cloth Lenny wrote: ↑Thu Oct 05, 2023 6:55 amI remember the 80’s when I was paying over 50% of my wages on my mortgage as interest rates were 15%.Long slender neck wrote: ↑Wed Oct 04, 2023 11:56 am Mortgage payments 27% of income- is that meant to be a high percentage?

-

Orient Punxx

- Bored office worker

- Posts: 2355

- Joined: Thu Apr 11, 2019 10:30 pm

- Has thanked: 1986 times

- Been thanked: 457 times

-

Tuffers#2

- Tiresome troll

- Posts: 1701

- Joined: Thu Aug 17, 2023 4:24 pm

- Awards: Tuffers

- Has thanked: 691 times

- Been thanked: 235 times

Re: House selling prices

More likely 300cc bubble car sold for £100 in 1982 to cover the mortgage.o-no wrote: ↑Thu Oct 05, 2023 10:15 pmPrincess Vanden Plas?Loin Cloth Lenny wrote: ↑Thu Oct 05, 2023 8:47 pm It went down to about 12% after about year or so as far as I can recall . Rates in the 70’s and early 80’s were always around 7% or more. Banks only offer fixed rates when they fancy the rates will go down. It was touch and go for ages when rates were 15%, my wages were not increasing and I had to sell my nice car to make ends meet.

- Dunners

- Boardin' 24/7

- Posts: 9790

- Joined: Thu Apr 11, 2019 4:21 pm

- Has thanked: 1203 times

- Been thanked: 2694 times

Re: House selling prices

In 1980 the average family spent just 9% of their income on housing costs; in 2021 that figure stood at 17%. By the end of next year it will be 27%.

These are averages. The lower a household's income, then the higher percentage their housing costs will be.

It's stripping the working class of their access to property ownership and the store of wealth that provides. But this doesn't stop there. It is now moving up the social ladder and affecting the middle classes. At an accelerating rate.

These are averages. The lower a household's income, then the higher percentage their housing costs will be.

It's stripping the working class of their access to property ownership and the store of wealth that provides. But this doesn't stop there. It is now moving up the social ladder and affecting the middle classes. At an accelerating rate.

-

Daily Express bot

- Tiresome troll

- Posts: 1468

- Joined: Sun Aug 13, 2023 5:26 am

- Has thanked: 733 times

- Been thanked: 114 times

Re: House selling prices

I thought I was your foe? Did you miss me?Joe315 wrote: ↑Thu Nov 09, 2023 2:04 amMore likely 300cc bubble car sold for £100 in 1982 to cover the mortgage.o-no wrote: ↑Thu Oct 05, 2023 10:15 pmPrincess Vanden Plas?Loin Cloth Lenny wrote: ↑Thu Oct 05, 2023 8:47 pm It went down to about 12% after about year or so as far as I can recall . Rates in the 70’s and early 80’s were always around 7% or more. Banks only offer fixed rates when they fancy the rates will go down. It was touch and go for ages when rates were 15%, my wages were not increasing and I had to sell my nice car to make ends meet.

-

Daily Express bot

- Tiresome troll

- Posts: 1468

- Joined: Sun Aug 13, 2023 5:26 am

- Has thanked: 733 times

- Been thanked: 114 times

Re: House selling prices

I do not know where you got those figures from but it does not relate to what I was paying for my property then. I was paying half my salary to pay for just my mortgage them. Had rates and energy on top of that. I had a well paid job too .Dunners wrote: ↑Thu Nov 09, 2023 6:43 am In 1980 the average family spent just 9% of their income on housing costs; in 2021 that figure stood at 17%. By the end of next year it will be 27%.

These are averages. The lower a household's income, then the higher percentage their housing costs will be.

It's stripping the working class of their access to property ownership and the store of wealth that provides. But this doesn't stop there. It is now moving up the social ladder and affecting the middle classes. At an accelerating rate.

- Dunners

- Boardin' 24/7

- Posts: 9790

- Joined: Thu Apr 11, 2019 4:21 pm

- Has thanked: 1203 times

- Been thanked: 2694 times

Re: House selling prices

Figures are from Resolution Foundation. And of course they do not relate to what you were paying. As I said, they are averages. This is about looking at the national picture, not just you.Loin Cloth Lenny wrote: ↑Thu Nov 09, 2023 6:54 amI do not know where you got those figures from but it does not relate to what I was paying for my property then. I was paying half my salary to pay for just my mortgage them. Had rates and energy on top of that. I had a well paid job too .Dunners wrote: ↑Thu Nov 09, 2023 6:43 am In 1980 the average family spent just 9% of their income on housing costs; in 2021 that figure stood at 17%. By the end of next year it will be 27%.

These are averages. The lower a household's income, then the higher percentage their housing costs will be.

It's stripping the working class of their access to property ownership and the store of wealth that provides. But this doesn't stop there. It is now moving up the social ladder and affecting the middle classes. At an accelerating rate.

-

Daily Express bot

- Tiresome troll

- Posts: 1468

- Joined: Sun Aug 13, 2023 5:26 am

- Has thanked: 733 times

- Been thanked: 114 times

Re: House selling prices

Yes but I am saying that they are so wide of the mark. I am saying I was paying over 70% of my income on mortgage payments and rates in 1980. I was on a decent salary then also. Interest rates then were far higher than they currently are now. I am not asking it to be about me but am informing you what the real world was like from my own experience then.Dunners wrote: ↑Thu Nov 09, 2023 6:58 amFigures are from Resolution Foundation. And of course they do not relate to what you were paying. As I said, they are averages. This is about looking at the national picture, not just you.Loin Cloth Lenny wrote: ↑Thu Nov 09, 2023 6:54 amI do not know where you got those figures from but it does not relate to what I was paying for my property then. I was paying half my salary to pay for just my mortgage them. Had rates and energy on top of that. I had a well paid job too .Dunners wrote: ↑Thu Nov 09, 2023 6:43 am In 1980 the average family spent just 9% of their income on housing costs; in 2021 that figure stood at 17%. By the end of next year it will be 27%.

These are averages. The lower a household's income, then the higher percentage their housing costs will be.

It's stripping the working class of their access to property ownership and the store of wealth that provides. But this doesn't stop there. It is now moving up the social ladder and affecting the middle classes. At an accelerating rate.

-

spen666

- Regular

- Posts: 3357

- Joined: Thu Apr 11, 2019 12:08 pm

- Has thanked: 1163 times

- Been thanked: 496 times

Re: House selling prices

"Recollections may Vary" to quote some rich old ladyLoin Cloth Lenny wrote: ↑Thu Nov 09, 2023 8:24 amYes but I am saying that they are so wide of the mark. I am saying I was paying over 70% of my income on mortgage payments and rates in 1980. I was on a decent salary then also. Interest rates then were far higher than they currently are now. I am not asking it to be about me but am informing you what the real world was like from my own experience then.Dunners wrote: ↑Thu Nov 09, 2023 6:58 amFigures are from Resolution Foundation. And of course they do not relate to what you were paying. As I said, they are averages. This is about looking at the national picture, not just you.Loin Cloth Lenny wrote: ↑Thu Nov 09, 2023 6:54 am

I do not know where you got those figures from but it does not relate to what I was paying for my property then. I was paying half my salary to pay for just my mortgage them. Had rates and energy on top of that. I had a well paid job too .

-

Daily Express bot

- Tiresome troll

- Posts: 1468

- Joined: Sun Aug 13, 2023 5:26 am

- Has thanked: 733 times

- Been thanked: 114 times

Re: House selling prices

Not in my case, I have my mortgage statements and pay slips going back donkeys years.spen666 wrote: ↑Thu Nov 09, 2023 9:36 am"Recollections may Vary" to quote some rich old ladyLoin Cloth Lenny wrote: ↑Thu Nov 09, 2023 8:24 amYes but I am saying that they are so wide of the mark. I am saying I was paying over 70% of my income on mortgage payments and rates in 1980. I was on a decent salary then also. Interest rates then were far higher than they currently are now. I am not asking it to be about me but am informing you what the real world was like from my own experience then.

Not difficult to find out what the interest rates were then.

Building materials were expensive pro rata then but nowhere near what they are now. I think a pint was over a pound then . A decent meal out and a drink about a fiver. I had a second hand mark 2 Escort which I bought for £85.00 off a work colleague

-

Tuffers#2

- Tiresome troll

- Posts: 1701

- Joined: Thu Aug 17, 2023 4:24 pm

- Awards: Tuffers

- Has thanked: 691 times

- Been thanked: 235 times

-

Tuffers#2

- Tiresome troll

- Posts: 1701

- Joined: Thu Aug 17, 2023 4:24 pm

- Awards: Tuffers

- Has thanked: 691 times

- Been thanked: 235 times

Re: House selling prices

Oiram sells car due to high mortgage in the 80s.Loin Cloth Lenny wrote: ↑Thu Oct 05, 2023 8:47 pm It went down to about 12% after about year or so as far as I can recall . Rates in the 70’s and early 80’s were always around 7% or more. Banks only offer fixed rates when they fancy the rates will go down. It was touch and go for ages when rates were 15%, my wages were not increasing and I had to sell my nice car to make ends meet.