Page 5 of 7

Re: House selling prices

Posted: Wed Sep 27, 2023 11:47 am

by Friend or faux

Dunners wrote: ↑Wed Sep 27, 2023 11:31 am

I reckon the youth of today should be made to re-enact the D-day landings, under live fire, before they can qualify for any mortgage product.

That'll teach 'em.

At last some sensible messaging on this Board. This could replace The Duke of Edinburgh Award Scheme.

Re: House selling prices

Posted: Thu Sep 28, 2023 8:59 am

by Dunners

Here comes the crunch:

www.theguardian.com/money/2023/sep/28/m ... sions-kpmg

"

UK mortgage payers making big changes to meet higher payments, survey finds

Britons are raiding savings or cutting pension contributions, KPMG study finds"

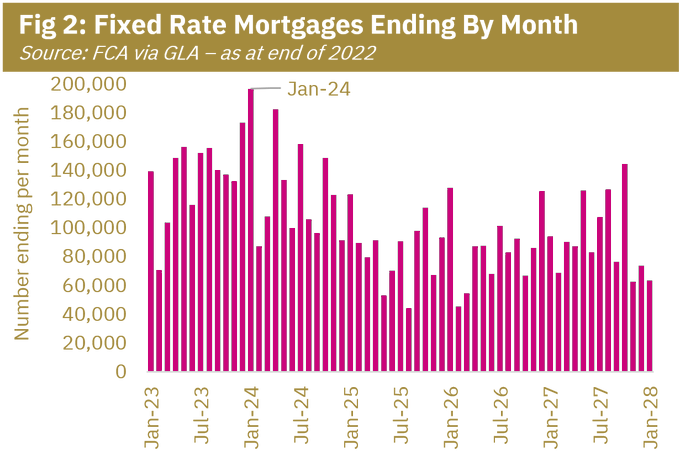

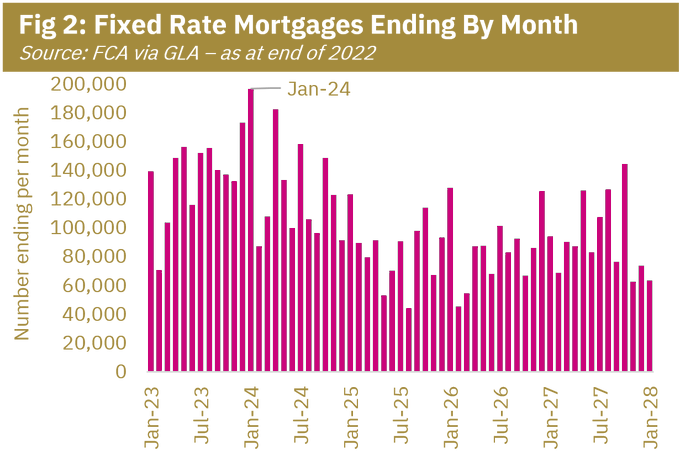

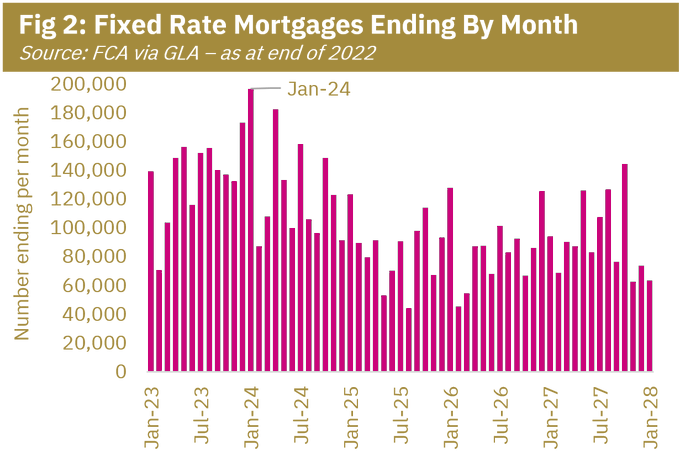

On average 100,000 households a month are coming off historically low fixed-interest mortgage deals, and being hit with much higher fixed rates (if they are lucky) or going onto standard variables. And for most of those households, their mortgage repayments will jump to a level that's equivilent to 27% of their income.

But this figure is an average. In this coming December and January, it'll be 360,000 households. Merry Christmas.

(Also, for those paying attention, this is one of the reasons why the Conservatives are going to double-down on "culture war" tactics in the run up to the next election)

Re: House selling prices

Posted: Thu Sep 28, 2023 9:33 am

by Give it to Jabo

Max B Gold wrote: ↑Wed Sep 27, 2023 9:56 am

Give it to Jabo wrote: ↑Tue Sep 26, 2023 12:36 pm

Other side of the coin. I have started a job in a college and the topic of D Day came up. Precious few of the learners had a clue about this event. I thought about all those people who sacrificed their lives etc...

Interesting. What subject do you teach?

English - to Functional Skills and GCSE Levels. The learners are enrolled on vocational courses but have to study Maths/English. Almost all of them are "good sorts".

Re: House selling prices

Posted: Wed Oct 04, 2023 11:46 am

by Dunners

Finally, some common sense. The Housing Minister has confirmed at the Tory conference that Help to Buy is dead.

“If we incentivise through Help to Buy, First Homes, or any of these schemes, that’s great for those people, but it inflates the prices. Demand has to be balanced with the supply side.”

We're already beginning to see the financial destitution this ridiculous policy is having on households who purchased using HTB. It would be up there with the PPI scandal if it were not so heavily caveated through conveyancers.

Re: House selling prices

Posted: Wed Oct 04, 2023 11:56 am

by Long slender neck

Mortgage payments 27% of income- is that meant to be a high percentage?

Re: House selling prices

Posted: Thu Oct 05, 2023 6:55 am

by Daily Express bot

Long slender neck wrote: ↑Wed Oct 04, 2023 11:56 am

Mortgage payments 27% of income- is that meant to be a high percentage?

I remember the 80’s when I was paying over 50% of my wages on my mortgage as interest rates were 15%.

Re: House selling prices

Posted: Thu Oct 05, 2023 6:49 pm

by OyinbO

Loin Cloth Lenny wrote: ↑Thu Oct 05, 2023 6:55 am

Long slender neck wrote: ↑Wed Oct 04, 2023 11:56 am

Mortgage payments 27% of income- is that meant to be a high percentage?

I remember the 80’s when I was paying over 50% of my wages on my mortgage as interest rates were 15%.

For how long?

Wage inflation was much higher then too.

Re: House selling prices

Posted: Thu Oct 05, 2023 8:47 pm

by Daily Express bot

It went down to about 12% after about year or so as far as I can recall . Rates in the 70’s and early 80’s were always around 7% or more. Banks only offer fixed rates when they fancy the rates will go down. It was touch and go for ages when rates were 15%, my wages were not increasing and I had to sell my nice car to make ends meet.

Re: House selling prices

Posted: Thu Oct 05, 2023 9:19 pm

by OyinbO

The structure of the mortgage market has changed a great deal since the 80s. Fixed rates were very rare then, almost everyone was on the SVR, so there was no lag between base rate changes and the effect on mortgagors.

Re: House selling prices

Posted: Thu Oct 05, 2023 10:15 pm

by o-no

Loin Cloth Lenny wrote: ↑Thu Oct 05, 2023 8:47 pm

It went down to about 12% after about year or so as far as I can recall . Rates in the 70’s and early 80’s were always around 7% or more. Banks only offer fixed rates when they fancy the rates will go down. It was touch and go for ages when rates were 15%, my wages were not increasing and I had to sell my nice car to make ends meet.

Princess Vanden Plas?

Re: House selling prices

Posted: Thu Oct 05, 2023 10:25 pm

by Daily Express bot

o-no wrote: ↑Thu Oct 05, 2023 10:15 pm

Loin Cloth Lenny wrote: ↑Thu Oct 05, 2023 8:47 pm

It went down to about 12% after about year or so as far as I can recall . Rates in the 70’s and early 80’s were always around 7% or more. Banks only offer fixed rates when they fancy the rates will go down. It was touch and go for ages when rates were 15%, my wages were not increasing and I had to sell my nice car to make ends meet.

Princess Vanden Plas?

MGB Roadster, paid the loan for 4 or 5 months!

Re: House selling prices

Posted: Thu Oct 05, 2023 10:31 pm

by Daily Express bot

Dunners wrote: ↑Thu Sep 28, 2023 8:59 am

Here comes the crunch:

www.theguardian.com/money/2023/sep/28/m ... sions-kpmg

"

UK mortgage payers making big changes to meet higher payments, survey finds

Britons are raiding savings or cutting pension contributions, KPMG study finds"

On average 100,000 households a month are coming off historically low fixed-interest mortgage deals, and being hit with much higher fixed rates (if they are lucky) or going onto standard variables. And for most of those households, their mortgage repayments will jump to a level that's equivilent to 27% of their income.

But this figure is an average. In this coming December and January, it'll be 360,000 households. Merry Christmas.

(Also, for those paying attention, this is one of the reasons why the Conservatives are going to double-down on "culture war" tactics in the run up to the next election)

In the real World, most prudent borrowers made overpayments or put money aside with the historically low interest rates, ‘saving for a rainy day’. This way you are ahead of your mortgage .

Re: House selling prices

Posted: Wed Nov 08, 2023 8:10 pm

by Dunners

Good on the Scotch.

Re: House selling prices

Posted: Thu Nov 09, 2023 12:32 am

by Adz

Loin Cloth Lenny wrote: ↑Thu Oct 05, 2023 6:55 am

Long slender neck wrote: ↑Wed Oct 04, 2023 11:56 am

Mortgage payments 27% of income- is that meant to be a high percentage?

I remember the 80’s when I was paying over 50% of my wages on my mortgage as interest rates were 15%.

Pah, we're currently paying 50% of our COMBINED wage on our mortgage. You cant look at interest rates in isolation, they need to be compared in conjunction with house prices and wages. When you do that, the effect of current interest rates are worse than the 80s.

Re: House selling prices

Posted: Thu Nov 09, 2023 1:44 am

by Orient Punxx

Good summary imo…..

Re: House selling prices

Posted: Thu Nov 09, 2023 2:04 am

by Tuffers#2

o-no wrote: ↑Thu Oct 05, 2023 10:15 pm

Loin Cloth Lenny wrote: ↑Thu Oct 05, 2023 8:47 pm

It went down to about 12% after about year or so as far as I can recall . Rates in the 70’s and early 80’s were always around 7% or more. Banks only offer fixed rates when they fancy the rates will go down. It was touch and go for ages when rates were 15%, my wages were not increasing and I had to sell my nice car to make ends meet.

Princess Vanden Plas?

More likely 300cc bubble car sold for £100 in 1982 to cover the mortgage.

Re: House selling prices

Posted: Thu Nov 09, 2023 6:43 am

by Dunners

In 1980 the average family spent just 9% of their income on housing costs; in 2021 that figure stood at 17%. By the end of next year it will be 27%.

These are averages. The lower a household's income, then the higher percentage their housing costs will be.

It's stripping the working class of their access to property ownership and the store of wealth that provides. But this doesn't stop there. It is now moving up the social ladder and affecting the middle classes. At an accelerating rate.

Re: House selling prices

Posted: Thu Nov 09, 2023 6:48 am

by Daily Express bot

Joe315 wrote: ↑Thu Nov 09, 2023 2:04 am

o-no wrote: ↑Thu Oct 05, 2023 10:15 pm

Loin Cloth Lenny wrote: ↑Thu Oct 05, 2023 8:47 pm

It went down to about 12% after about year or so as far as I can recall . Rates in the 70’s and early 80’s were always around 7% or more. Banks only offer fixed rates when they fancy the rates will go down. It was touch and go for ages when rates were 15%, my wages were not increasing and I had to sell my nice car to make ends meet.

Princess Vanden Plas?

More likely 300cc bubble car sold for £100 in 1982 to cover the mortgage.

I thought I was your foe? Did you miss me?

Re: House selling prices

Posted: Thu Nov 09, 2023 6:54 am

by Daily Express bot

Dunners wrote: ↑Thu Nov 09, 2023 6:43 am

In 1980 the

average family spent just 9% of their income on housing costs; in 2021 that figure stood at 17%. By the end of next year it will be 27%.

These are averages. The lower a household's income, then the higher percentage their housing costs will be.

It's stripping the working class of their access to property ownership and the store of wealth that provides. But this doesn't stop there. It is now moving up the social ladder and affecting the middle classes. At an accelerating rate.

I do not know where you got those figures from but it does not relate to what I was paying for my property then. I was paying half my salary to pay for just my mortgage them. Had rates and energy on top of that. I had a well paid job too .

Re: House selling prices

Posted: Thu Nov 09, 2023 6:58 am

by Dunners

Loin Cloth Lenny wrote: ↑Thu Nov 09, 2023 6:54 am

Dunners wrote: ↑Thu Nov 09, 2023 6:43 am

In 1980 the

average family spent just 9% of their income on housing costs; in 2021 that figure stood at 17%. By the end of next year it will be 27%.

These are averages. The lower a household's income, then the higher percentage their housing costs will be.

It's stripping the working class of their access to property ownership and the store of wealth that provides. But this doesn't stop there. It is now moving up the social ladder and affecting the middle classes. At an accelerating rate.

I do not know where you got those figures from but it does not relate to what I was paying for my property then. I was paying half my salary to pay for just my mortgage them. Had rates and energy on top of that. I had a well paid job too .

Figures are from Resolution Foundation. And of course they do not relate to what you were paying. As I said, they are

averages. This is about looking at the national picture, not just you.

Re: House selling prices

Posted: Thu Nov 09, 2023 8:24 am

by Daily Express bot

Dunners wrote: ↑Thu Nov 09, 2023 6:58 am

Loin Cloth Lenny wrote: ↑Thu Nov 09, 2023 6:54 am

Dunners wrote: ↑Thu Nov 09, 2023 6:43 am

In 1980 the

average family spent just 9% of their income on housing costs; in 2021 that figure stood at 17%. By the end of next year it will be 27%.

These are averages. The lower a household's income, then the higher percentage their housing costs will be.

It's stripping the working class of their access to property ownership and the store of wealth that provides. But this doesn't stop there. It is now moving up the social ladder and affecting the middle classes. At an accelerating rate.

I do not know where you got those figures from but it does not relate to what I was paying for my property then. I was paying half my salary to pay for just my mortgage them. Had rates and energy on top of that. I had a well paid job too .

Figures are from Resolution Foundation. And of course they do not relate to what you were paying. As I said, they are

averages. This is about looking at the national picture, not just you.

Yes but I am saying that they are so wide of the mark. I am saying I was paying over 70% of my income on mortgage payments and rates in 1980. I was on a decent salary then also. Interest rates then were far higher than they currently are now. I am not asking it to be about me but am informing you what the real world was like from my own experience then.

Re: House selling prices

Posted: Thu Nov 09, 2023 9:36 am

by spen666

Loin Cloth Lenny wrote: ↑Thu Nov 09, 2023 8:24 am

Dunners wrote: ↑Thu Nov 09, 2023 6:58 am

Loin Cloth Lenny wrote: ↑Thu Nov 09, 2023 6:54 am

I do not know where you got those figures from but it does not relate to what I was paying for my property then. I was paying half my salary to pay for just my mortgage them. Had rates and energy on top of that. I had a well paid job too .

Figures are from Resolution Foundation. And of course they do not relate to what you were paying. As I said, they are

averages. This is about looking at the national picture, not just you.

Yes but I am saying that they are so wide of the mark. I am saying I was paying over 70% of my income on mortgage payments and rates in 1980. I was on a decent salary then also. Interest rates then were far higher than they currently are now. I am not asking it to be about me but am informing you what the real world was like from my own experience then.

"Recollections may Vary" to quote some rich old lady

Re: House selling prices

Posted: Thu Nov 09, 2023 9:42 am

by Daily Express bot

spen666 wrote: ↑Thu Nov 09, 2023 9:36 am

Loin Cloth Lenny wrote: ↑Thu Nov 09, 2023 8:24 am

Dunners wrote: ↑Thu Nov 09, 2023 6:58 am

Figures are from Resolution Foundation. And of course they do not relate to what you were paying. As I said, they are

averages. This is about looking at the national picture, not just you.

Yes but I am saying that they are so wide of the mark. I am saying I was paying over 70% of my income on mortgage payments and rates in 1980. I was on a decent salary then also. Interest rates then were far higher than they currently are now. I am not asking it to be about me but am informing you what the real world was like from my own experience then.

"Recollections may Vary" to quote some rich old lady

Not in my case, I have my mortgage statements and pay slips going back donkeys years.

Not difficult to find out what the interest rates were then.

Building materials were expensive pro rata then but nowhere near what they are now. I think a pint was over a pound then . A decent meal out and a drink about a fiver. I had a second hand mark 2 Escort which I bought for £85.00 off a work colleague

Re: House selling prices

Posted: Thu Nov 09, 2023 10:03 am

by Tuffers#2

Loin Cloth Lenny wrote: ↑Thu Nov 09, 2023 6:48 am

Joe315 wrote: ↑Thu Nov 09, 2023 2:04 am

o-no wrote: ↑Thu Oct 05, 2023 10:15 pm

Princess Vanden Plas?

More likely 300cc bubble car sold for £100 in 1982 to cover the mortgage.

I thought I was your foe? Did you miss me?

You are on foe Oiram. If someone quotes you I see it.

Re: House selling prices

Posted: Thu Nov 09, 2023 10:05 am

by Tuffers#2

Loin Cloth Lenny wrote: ↑Thu Oct 05, 2023 8:47 pm

It went down to about 12% after about year or so as far as I can recall . Rates in the 70’s and early 80’s were always around 7% or more. Banks only offer fixed rates when they fancy the rates will go down. It was touch and go for ages when rates were 15%, my wages were not increasing and I had to sell my nice car to make ends meet.

Oiram sells car due to high mortgage in the 80s.