Page 1 of 2

Interest Rates

Posted: Fri Nov 03, 2023 3:49 pm

by Harlow

Are the Bank of England behind the curve with interest rates?

This week Company failures are reported at being the highest since 2009 (post credit crunch) and i have just read that massive shipping company Maersk are cutring a further 3500 jobs following 6500 cut earlier this year. Shipping container rates have collapsed to £2000 from £18000.

House sales seemed to have reduced, prices have actually risen because of low supply, in the past a bouyant housing market helped drive the economy. When people have to start remortgaging at higher rates that may suppress demand in the economy even further. Ok savers receive more but will they spend, more likely to boost their savings I suspect

I am sure that in years gone by we went from boom to bust very quickly. The problem is we haven't been in boom for years so a bust could be very painfull.

What do others think? Should rates be coming down to avoid recession?

Re: Interest Rates

Posted: Fri Nov 03, 2023 4:15 pm

by Beradogs

Looking at the data out of the States today, rate rises are probably done for now. Where the U.S leads we follow.

Re: Interest Rates

Posted: Fri Nov 03, 2023 4:20 pm

by Dunners

Yep, the BoE has clearly been tracking the US. Personally, I quite like a period of high interest rates, but I appreciate it will be hurting many. But we had to break from the addiction to ultra-low rate at some point and it was never going to be pain free.

Re: Interest Rates

Posted: Fri Nov 03, 2023 9:32 pm

by Adz

The problem is that the boe have a mandate to bring down inflation and only a hammer (interest rates) to deal with it. They work independently of the government who have a full tool box at their disposal, but no mandate to bring inflation in line. Increasing interest rates has done nothing to reduce inflation (and if you look deeply into it may have actually increased it). You can only affect internal inflation and consumer demand has never got off the ropes.

Personally I think governments could look at running different interest rates for parts of the economy that when increased are inflationary

Re: Interest Rates

Posted: Sat Nov 04, 2023 12:58 am

by Orient Punxx

Adz wrote: ↑Fri Nov 03, 2023 9:32 pm

The problem is that the boe have a mandate to bring down inflation and only a hammer (interest rates) to deal with it. They work independently of the government who have a full tool box at their disposal, but no mandate to bring inflation in line. Increasing interest rates has done nothing to reduce inflation (and if you look deeply into it may have actually increased it). You can only affect internal inflation and consumer demand has never got off the ropes.

Personally I think governments could look at running different interest rates for parts of the economy that when increased are inflationary

You’re on the money there.

Re: Interest Rates

Posted: Sat Nov 04, 2023 5:42 am

by Daily Express bot

Interest rates still substantially lower than they have been in last 30 years . The ridiculously low rates for a prolonged period post Cameron was an ideal opportunity for saving money for a rainy day or to overpay your mortgage for eventualities like the small print warn (rates can go up as well as down). The housing market has it the buffers at the moment after many years of sustained growth. These reports of falls of 0.2% are quite ridiculous when in reality decentvsoughtbafter homes made of bricks and mortar have doubled in the last 10/12 years. The problems sales affecting the market are the shared ownership which are problematic to resell except back to the freeholder normally at a loss or the recent new builds like near the ground. I know people who have had all kinds of problems with the flats near the end of Church Road on site of old school. Cladding issues and very hard to sell. Trapped there having paid 600k for a new build only 5 years ago. Those ones opposite West Stand , will command huge Service charges, all these things affect the market and quite a modern day concept.

Re: Interest Rates

Posted: Sun Nov 05, 2023 1:41 am

by Eggski

My wife rates me and is still interested

Re: Interest Rates

Posted: Wed Jan 17, 2024 1:39 pm

by Hoover Attack

Interest rates won't be increasing despite the uptick in inflation. Inflation caused by the soaring price of DVDs, cat food, and theatre admission prices.

https://www.bbc.co.uk/news/business-67993276

Re: Interest Rates

Posted: Wed Jan 17, 2024 1:43 pm

by Dunners

I keep reading articles and opinion pieces predicting rate cuts. I have no idea what will happen myself, but I can never fathom what makes the authors so confident in their predictions other than wishful thinking.

And yeah, theatre admission prices are hitting hard if you're the type that pays with your own money.

Re: Interest Rates

Posted: Wed Jan 17, 2024 2:47 pm

by Daily Express bot

Dunners wrote: ↑Wed Jan 17, 2024 1:43 pm

I keep reading articles and opinion pieces predicting rate cuts. I have no idea what will happen myself, but I can never fathom what makes the authors so confident in their predictions other than wishful thinking.

And yeah, theatre admission prices are hitting hard if you're the type that pays with your own money.

I tried booking some theatre tickets tickets for Plaza Suite yesterday, almost sold out and decent ones £300 each!

Not that accessible to the average working man. With a meal out and a hotel stay you are looking at well over a £1000

Re: Interest Rates

Posted: Wed Jan 17, 2024 3:15 pm

by Dunners

Daily Express bot wrote: ↑Wed Jan 17, 2024 2:47 pm

Dunners wrote: ↑Wed Jan 17, 2024 1:43 pm

I keep reading articles and opinion pieces predicting rate cuts. I have no idea what will happen myself, but I can never fathom what makes the authors so confident in their predictions other than wishful thinking.

And yeah, theatre admission prices are hitting hard if you're the type that pays with your own money.

I tried booking some theatre tickets tickets for Plaza Suite yesterday, almost sold out and decent ones £300 each!

Not that accessible to the average working man. With a meal out and a hotel stay you are looking at well over a £1000

They're priced like that to keep the scum out.

Re: Interest Rates

Posted: Wed Jan 17, 2024 3:25 pm

by Daily Express bot

Well there are some super priced tickets for all kinds of theatre anc concerts at a fraction of the price and sites like Central Tickets offer numerous shows, concerts and theatre for as low as a fiver. I don’t consider the people I have seen attending as ‘scum’

Re: Interest Rates

Posted: Tue Jan 23, 2024 12:40 pm

by Dunners

Hmmm. Something's up. I'm hearing that we may be about to be hit by another wave of high inflation. Santander have also just announced withdrawal of some of their mortgage products, and are to increase the rates on those that will remain available.

I'd expect the disruption to shipping in the Red Sea to have some impact, but didn't think it would be noticeable for another four to six months. So not sure if it has anything to do with that or not. But I think another few months of c8%-10% inflation will make it all but impossible for the BoE of bring rates down. And if it's really bad they many need to consider further increases. It will be the final nail in the coffin for many businesses (and households).

Re: Interest Rates

Posted: Tue Jan 23, 2024 12:44 pm

by Hoover Attack

But we'll blame it on the Hoofies and Putin anyway, right?

Re: Interest Rates

Posted: Tue Jan 23, 2024 12:52 pm

by Dunners

Well, they may be deserving of some of the blame.

Putin's actions are already baked in. But the implications of attacks on commercial shipping is that, allowing for typical supply chain logistics, we'd expect any shortage on the shelves to appear 4-6 months later. So if we do see a spike in inflation between now and - say - April, then I'd be sceptical of any claim that it is directly attributable to the Hoofies.

Re: Interest Rates

Posted: Tue Jan 23, 2024 12:53 pm

by Rich Tea Wellin

CEOs just missing the profits from 6 months ago and price hiking everything

Re: Interest Rates

Posted: Tue Jan 23, 2024 1:13 pm

by LittleMate

Adz wrote: ↑Fri Nov 03, 2023 9:32 pm

The problem is that the boe have a mandate to bring down inflation and only a hammer (interest rates) to deal with it. They work independently of the government who have a full tool box at their disposal, but no mandate to bring inflation in line. Increasing interest rates has done nothing to reduce inflation (and if you look deeply into it may have actually increased it). You can only affect internal inflation and consumer demand has never got off the ropes.

Personally I think governments could look at running different interest rates for parts of the economy that when increased are inflationary

The problem with this is that the ones with all the tools are apprentices!

As they say in golf. All the gear, no idea!!

Re: Interest Rates

Posted: Wed Jan 24, 2024 12:49 am

by Adz

Rich Tea Wellin wrote: ↑Tue Jan 23, 2024 12:53 pm

CEOs just missing the profits from 6 months ago and price hiking everything

Competition watchdog has been asleep at the wheel for years, no surprise companies are now running roughshod over the consumer.

Re: Interest Rates

Posted: Wed Jan 24, 2024 7:53 am

by Daily Express bot

I am glad the rates are controlled by the banks and we are still at historically low rates. I was paying three above base in the 80s for commercial rates at 18%. Now those rates made your eyes water.

Re: Interest Rates

Posted: Wed Jan 24, 2024 8:03 am

by Adz

Daily Express bot wrote: ↑Wed Jan 24, 2024 7:53 am

I am glad the rates are controlled by the banks and we are still at historically low rates. I was paying three above base in the 80s for commercial rates at 18%. Now those rates made your eyes water.

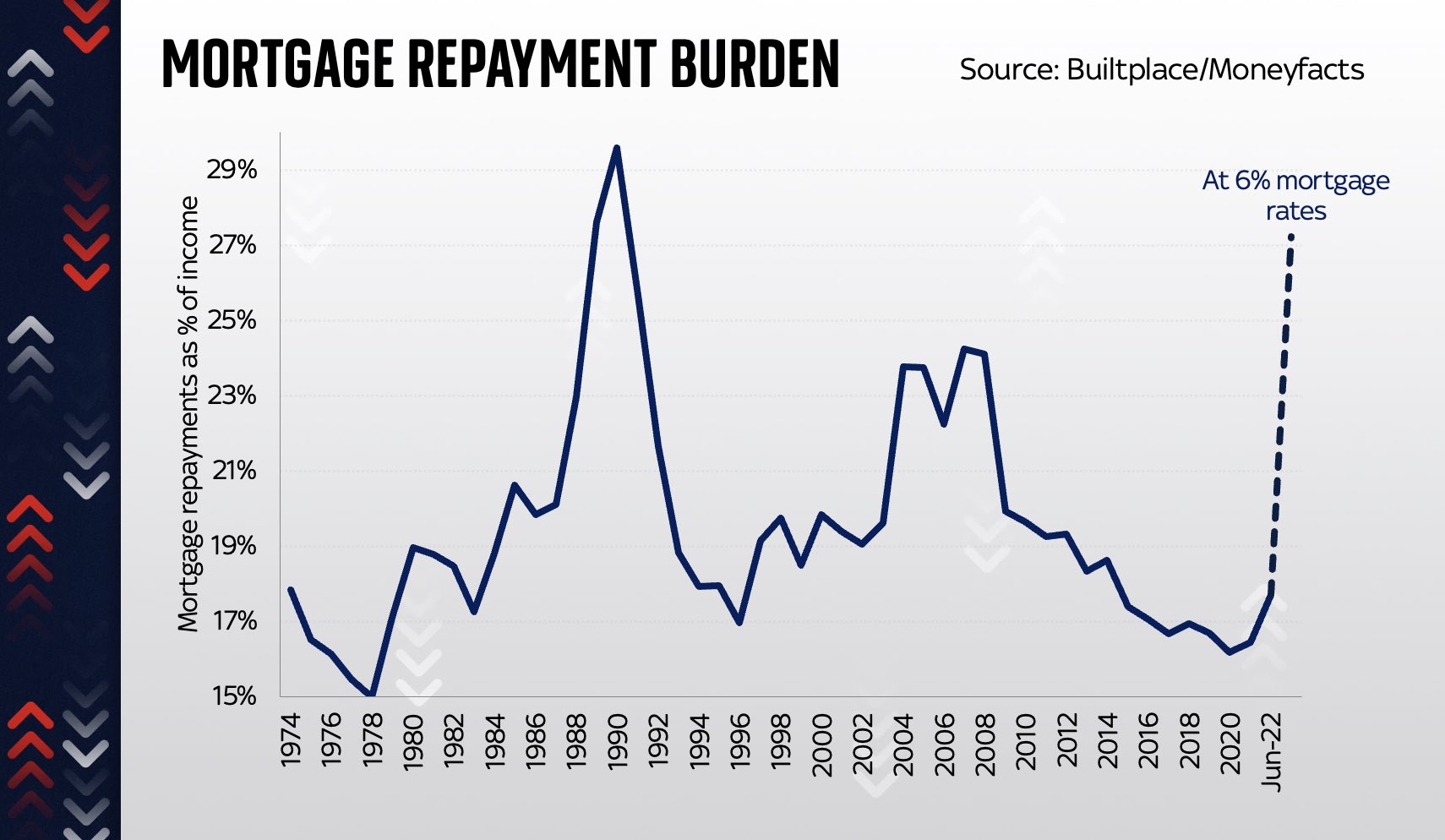

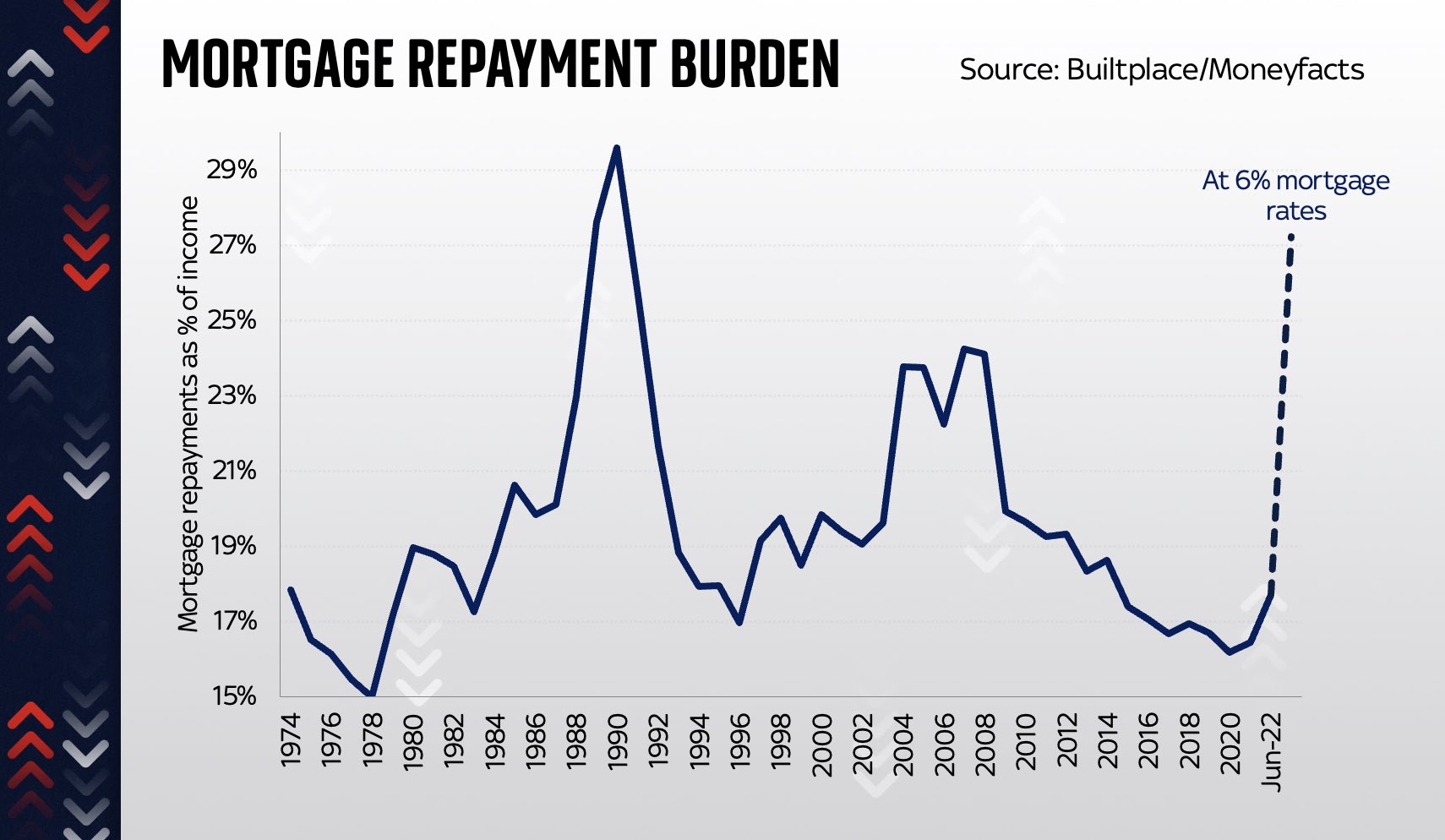

You can't look at rates in isolation, you have to consider asset values. Times are tougher now for young people than the 80s.

Re: Interest Rates

Posted: Wed Jan 24, 2024 8:45 am

by Daily Express bot

Adz wrote: ↑Wed Jan 24, 2024 8:03 am

Daily Express bot wrote: ↑Wed Jan 24, 2024 7:53 am

I am glad the rates are controlled by the banks and we are still at historically low rates. I was paying three above base in the 80s for commercial rates at 18%. Now those rates made your eyes water.

You can't look at rates in isolation, you have to consider asset values. Times are tougher now for young people than the 80s.

True, but property I bought for under 100k was still a struggle to pay for when rates 18% and wages so low then. All relative.

Re: Interest Rates

Posted: Wed Jan 24, 2024 8:58 am

by Rich Tea Wellin

Daily Express bot wrote: ↑Wed Jan 24, 2024 8:45 am

Adz wrote: ↑Wed Jan 24, 2024 8:03 am

Daily Express bot wrote: ↑Wed Jan 24, 2024 7:53 am

I am glad the rates are controlled by the banks and we are still at historically low rates. I was paying three above base in the 80s for commercial rates at 18%. Now those rates made your eyes water.

You can't look at rates in isolation, you have to consider asset values. Times are tougher now for young people than the 80s.

True, but property I bought for under 100k was still a struggle to pay for when rates 18% and wages so low then. All relative.

Poor you

Re: Interest Rates

Posted: Wed Jan 24, 2024 9:00 am

by Dunners

Daily Express bot wrote: ↑Wed Jan 24, 2024 8:45 am

Adz wrote: ↑Wed Jan 24, 2024 8:03 am

Daily Express bot wrote: ↑Wed Jan 24, 2024 7:53 am

I am glad the rates are controlled by the banks and we are still at historically low rates. I was paying three above base in the 80s for commercial rates at 18%. Now those rates made your eyes water.

You can't look at rates in isolation, you have to consider asset values. Times are tougher now for young people than the 80s.

True, but property I bought for under 100k was still a struggle to pay for when rates 18% and wages so low then. All relative.

That's the point. It is relative. And, when adjusted, currently homeowners have it just as bad as you did. And renters have it much worse than you did.

This has already been explained on another thread...

Dunners wrote: ↑Mon Sep 11, 2023 10:18 am

When adjusted for current levels of household borrowing, this will feel

worse than double-digit rates in 1980. This is mainly because, during the above period of ultra-low rates, household borrowing has increased to record highs.

Re: Interest Rates

Posted: Wed Jan 24, 2024 9:23 am

by Hoover Attack

Daily Express bot wrote: ↑Wed Jan 24, 2024 8:45 am

Adz wrote: ↑Wed Jan 24, 2024 8:03 am

Daily Express bot wrote: ↑Wed Jan 24, 2024 7:53 am

I am glad the rates are controlled by the banks and we are still at historically low rates. I was paying three above base in the 80s for commercial rates at 18%. Now those rates made your eyes water.

You can't look at rates in isolation, you have to consider asset values. Times are tougher now for young people than the 80s.

True, but property I bought for under 100k was still a struggle to pay for when rates 18% and wages so low then. All relative.

Hope your ok mate

Re: Interest Rates

Posted: Wed Jan 24, 2024 9:25 am

by Hoover Attack

Dunners wrote: ↑Wed Jan 24, 2024 9:00 am

That's the point. It is relative. And, when adjusted, currently homeowners have it just as bad as you did. And renters have it much worse than you did.

What about landlords, how is it for them? How comes they're never considered in these discussions?