Has better structural resilience than a modern new-build property too.

House selling prices

Moderator: Long slender neck

- Dunners

- Boardin' 24/7

- Posts: 9033

- Joined: Thu Apr 11, 2019 4:21 pm

- Has thanked: 1074 times

- Been thanked: 2497 times

- Long slender neck

- MB Legend

- Posts: 14313

- Joined: Fri Apr 12, 2019 9:13 am

- Has thanked: 2509 times

- Been thanked: 3298 times

Re: House selling prices

Its totally crazy that a BTL Scumbag would wet the bed over having to chip in a few quid of their own money into a house being paid for for them by a poor person.Dunners wrote: ↑Sun Sep 10, 2023 8:39 pmYes, obviously.Long slender neck wrote: ↑Sun Sep 10, 2023 8:21 pm But if they don’t have interest only mortgage then their asset is being paid for.

Assuming their other costs do not exceed their income from time to time.

- Dunners

- Boardin' 24/7

- Posts: 9033

- Joined: Thu Apr 11, 2019 4:21 pm

- Has thanked: 1074 times

- Been thanked: 2497 times

Re: House selling prices

It could be significantly more than a few quid.Long slender neck wrote: ↑Sun Sep 10, 2023 9:06 pmIts totally crazy that a BTL Scumbag would wet the bed over having to chip in a few quid of their own money into a house being paid for for them by a poor person.Dunners wrote: ↑Sun Sep 10, 2023 8:39 pmYes, obviously.Long slender neck wrote: ↑Sun Sep 10, 2023 8:21 pm But if they don’t have interest only mortgage then their asset is being paid for.

Assuming their other costs do not exceed their income from time to time.

Some, who are not too affected by mortgage rate increases, will tough it out. But if you're a BTL investor and taking a strictly dispassionate and commercial view of your investment options, then BTL is out.

- Max Fowler

- Boardin' 24/7

- Posts: 5497

- Joined: Tue Mar 23, 2021 12:18 pm

- Has thanked: 509 times

- Been thanked: 1262 times

Re: House selling prices

https://www.moneysupermarket.com/mortga ... ders=false

Just an example, £400k property, 75% borrowings, £1,800 per month repayment mortgage. You won't get that in as rent. You could whack the £100k capital anywhere and get £5k per annum.

The numbers just don't stack up anymore.

Just an example, £400k property, 75% borrowings, £1,800 per month repayment mortgage. You won't get that in as rent. You could whack the £100k capital anywhere and get £5k per annum.

The numbers just don't stack up anymore.

-

BoniO

- Regular

- Posts: 4699

- Joined: Sat Apr 13, 2019 3:36 pm

- Has thanked: 1116 times

- Been thanked: 752 times

Re: House selling prices

OK Max.Rich Tea Wellin wrote: ↑Sun Sep 10, 2023 8:40 pmWhy don’t you go and find out yourself by asking an estate agent rather than posting on here? I know Dunners doesn’t care about your rudeness but he’s posted a decent reply and you’ve just been nasty - not your first time on here being nasty and rude.BoniO wrote: ↑Sun Sep 10, 2023 4:17 pmWhat are you on about? My question is purely about the use and meaning of the posted phrase. Absolutely nothing to do with buy to let. I was just wondering if there any estate agents on here who might shed some light. Some real numpties on this board.Dunners wrote: ↑Sun Sep 10, 2023 2:53 pm It means nothing. Those are just figures to try and generate interest and, eventually, competitive bids. That's the best way for the vendor to achieve best price.

Right now prices are sliding. And all recently published figures (ONS, Nationwide, Halifax etc) are suggesting something in the region of a 5% slide since this time last year. But, those figures are all 6 months out of date.

This market has further to slide yet. The BTL crowd are beginning to panic, and listings are increasing (with buyer demand reducing). So only offer what you can afford assuming base rates at 6%, and that you'd be comfortable with a further slide into some negative equity territory.

I can try and post some of the recent economic and market analysis when I'm back in the office tomorrow. But feel free to take the piss with cheeky below guide price offers.

Don’t remember you standing out on the board before the last few months so maybe somethings happened and I hope you are ok but you are coming across badly recently.

-

Adz

- Bored office worker

- Posts: 2595

- Joined: Fri Apr 12, 2019 10:15 am

- Has thanked: 106 times

- Been thanked: 627 times

Re: House selling prices

When we left the UK we rented out our house, it was a massive ball ache to manage so sold it after it was obvious we weren't coming back.

Dunners, I assume you work in finance based on your posts, check out the Australian laws on property, they're mental. You can offset your income tax with negatively geared property and there is a capital gains tax discount. It's the reason house prices in Australia are insane.

Dunners, I assume you work in finance based on your posts, check out the Australian laws on property, they're mental. You can offset your income tax with negatively geared property and there is a capital gains tax discount. It's the reason house prices in Australia are insane.

- Max B Gold

- MB Legend

- Posts: 12332

- Joined: Thu Apr 11, 2019 2:12 pm

- Has thanked: 986 times

- Been thanked: 2806 times

Re: House selling prices

RudeBoniO wrote: ↑Sun Sep 10, 2023 10:09 pmOK Max.Rich Tea Wellin wrote: ↑Sun Sep 10, 2023 8:40 pmWhy don’t you go and find out yourself by asking an estate agent rather than posting on here? I know Dunners doesn’t care about your rudeness but he’s posted a decent reply and you’ve just been nasty - not your first time on here being nasty and rude.

Don’t remember you standing out on the board before the last few months so maybe somethings happened and I hope you are ok but you are coming across badly recently.

-

Daily Express bot

- Tiresome troll

- Posts: 1468

- Joined: Sun Aug 13, 2023 5:26 am

- Has thanked: 733 times

- Been thanked: 114 times

Re: House selling prices

So many regulations governing Landlords now , buy to let not a great place to invest. Landlord Licensing, various certificates, no off setting interest against Tax, maintenance, empty period Councul Tax Liability, Gas and Electric Certification , Minimum Energy Performance requirements . Many small and one property landlords are selling up. This reduces stock, less stock means higher demand for property available. This is one of the main reasons rents are increasing.Max Fowler wrote: ↑Sun Sep 10, 2023 4:19 pmBut current borrowing rates and current house prices mean it's not a great return.Long slender neck wrote: ↑Sun Sep 10, 2023 4:16 pm Always thought that getting someone else pay your mortgage seemed like a great investment, almost like a bug or exploit in the system.

- Rich Tea Wellin

- MB Legend

- Posts: 10537

- Joined: Thu Apr 11, 2019 7:01 pm

- Has thanked: 4569 times

- Been thanked: 3236 times

Re: House selling prices

You keep banging on about that. I don’t get it. Stop being overly aggressive and rude, it’s ridiculous behaviour, especially when you are asking for helpBoniO wrote: ↑Sun Sep 10, 2023 10:09 pmOK Max.Rich Tea Wellin wrote: ↑Sun Sep 10, 2023 8:40 pmWhy don’t you go and find out yourself by asking an estate agent rather than posting on here? I know Dunners doesn’t care about your rudeness but he’s posted a decent reply and you’ve just been nasty - not your first time on here being nasty and rude.

Don’t remember you standing out on the board before the last few months so maybe somethings happened and I hope you are ok but you are coming across badly recently.

-

BoniO

- Regular

- Posts: 4699

- Joined: Sat Apr 13, 2019 3:36 pm

- Has thanked: 1116 times

- Been thanked: 752 times

Re: House selling prices

Sorry Max.Rich Tea Wellin wrote: ↑Sun Sep 10, 2023 10:28 pmYou keep banging on about that. I don’t get it. Stop being overly aggressive and rude, it’s ridiculous behaviour, especially when you are asking for helpBoniO wrote: ↑Sun Sep 10, 2023 10:09 pmOK Max.Rich Tea Wellin wrote: ↑Sun Sep 10, 2023 8:40 pm

Why don’t you go and find out yourself by asking an estate agent rather than posting on here? I know Dunners doesn’t care about your rudeness but he’s posted a decent reply and you’ve just been nasty - not your first time on here being nasty and rude.

Don’t remember you standing out on the board before the last few months so maybe somethings happened and I hope you are ok but you are coming across badly recently.

- FrankOFile

- Fresh Alias

- Posts: 460

- Joined: Thu Oct 27, 2022 7:50 am

- Has thanked: 64 times

- Been thanked: 50 times

Re: House selling prices

No. It means £425 and above. The lower price is just to hook interest for those seeking a bargain.

- FrankOFile

- Fresh Alias

- Posts: 460

- Joined: Thu Oct 27, 2022 7:50 am

- Has thanked: 64 times

- Been thanked: 50 times

Re: House selling prices

This seems to be a gross overreaction.Rich Tea Wellin wrote: ↑Sun Sep 10, 2023 8:40 pmWhy don’t you go and find out yourself by asking an estate agent rather than posting on here? I know Dunners doesn’t care about your rudeness but he’s posted a decent reply and you’ve just been nasty - not your first time on here being nasty and rude.BoniO wrote: ↑Sun Sep 10, 2023 4:17 pmWhat are you on about? My question is purely about the use and meaning of the posted phrase. Absolutely nothing to do with buy to let. I was just wondering if there any estate agents on here who might shed some light. Some real numpties on this board.Dunners wrote: ↑Sun Sep 10, 2023 2:53 pm It means nothing. Those are just figures to try and generate interest and, eventually, competitive bids. That's the best way for the vendor to achieve best price.

Right now prices are sliding. And all recently published figures (ONS, Nationwide, Halifax etc) are suggesting something in the region of a 5% slide since this time last year. But, those figures are all 6 months out of date.

This market has further to slide yet. The BTL crowd are beginning to panic, and listings are increasing (with buyer demand reducing). So only offer what you can afford assuming base rates at 6%, and that you'd be comfortable with a further slide into some negative equity territory.

I can try and post some of the recent economic and market analysis when I'm back in the office tomorrow. But feel free to take the piss with cheeky below guide price offers.

Don’t remember you standing out on the board before the last few months so maybe somethings happened and I hope you are ok but you are coming across badly recently.

- Max Fowler

- Boardin' 24/7

- Posts: 5497

- Joined: Tue Mar 23, 2021 12:18 pm

- Has thanked: 509 times

- Been thanked: 1262 times

Re: House selling prices

When the poor, victimised landlords are forced to sell up, where do the properties go?Loin Cloth Lenny wrote: ↑Sun Sep 10, 2023 10:16 pm landlords are selling up. This reduces stock, less stock means higher demand for property available. This is one of the main reasons rents are increasing.

I'm not sure the stock of houses/homes actually decreases, does it?

-

Proposition Joe

- Regular

- Posts: 4715

- Joined: Thu Apr 11, 2019 8:48 pm

- Has thanked: 2068 times

- Been thanked: 1694 times

-

Daily Express bot

- Tiresome troll

- Posts: 1468

- Joined: Sun Aug 13, 2023 5:26 am

- Has thanked: 733 times

- Been thanked: 114 times

Re: House selling prices

I dont know why you are kind of attacking private landlords . Some are Landlords by change in circumstances, need bigger accommodation and cannot get a sale through or move away for work temporarily and will need to move back later. They are providing accommodation and not all Tenants report having a bad Landlord either.Max Fowler wrote: ↑Mon Sep 11, 2023 9:24 amWhen the poor, victimised landlords are forced to sell up, where do the properties go?Loin Cloth Lenny wrote: ↑Sun Sep 10, 2023 10:16 pm landlords are selling up. This reduces stock, less stock means higher demand for property available. This is one of the main reasons rents are increasing.

I'm not sure the stock of houses/homes actually decreases, does it?

In answer to your question. The sold properties go to the general market. They are either owner occupied or bought and let as buy to let’s again. The point is, it is not commercially viable these days to buy a flat in Leyton say for 600k like those opposite Brisbane Rd to let for 2.5k month. Totally illegal if bought on ‘domestic mortgage finance’ as well. Commercial finance commands higher rates so makes it even less viable. Only way it is still viable if you have a large sum of cash where you can invest in a flat and still get about 4-6% return gross on a buy to let in parts of London , maybe more outside London.

The point is that despite what politicians say about’nasty Landlords’ there is still a vast over dependance on Private Landlords by them. With many selling up and getting out, this has had an effect on rent prices by pushing rents up as less supply.

- Max Fowler

- Boardin' 24/7

- Posts: 5497

- Joined: Tue Mar 23, 2021 12:18 pm

- Has thanked: 509 times

- Been thanked: 1262 times

Re: House selling prices

I'm not sure where I have attacked anyone? You sound like one of those think-skinned, touchy landlord types.Loin Cloth Lenny wrote: ↑Mon Sep 11, 2023 9:40 am

In answer to your question. The sold properties go to the general market. They are either owner occupied or bought and let as buy to let’s again. T

So we have confirmed that the houses/homes do still exist - thank God for that! That's the most important thing. As a Landlord having to sell up doesn't change the stock of houses, and obviously has no impact on the number of people in the country, supply of houses and demand for houses sounds as if it is exactly the same?

- Dunners

- Boardin' 24/7

- Posts: 9033

- Joined: Thu Apr 11, 2019 4:21 pm

- Has thanked: 1074 times

- Been thanked: 2497 times

Re: House selling prices

Selling up, for some/many, may not be that straightforward.Max Fowler wrote: ↑Mon Sep 11, 2023 9:24 amWhen the poor, victimised landlords are forced to sell up, where do the properties go?Loin Cloth Lenny wrote: ↑Sun Sep 10, 2023 10:16 pm landlords are selling up. This reduces stock, less stock means higher demand for property available. This is one of the main reasons rents are increasing.

I'm not sure the stock of houses/homes actually decreases, does it?

Hopefully, over a longer timeframe, it could all self-correct and the public have access to more affordable housing options. But even taking that optimistic view, I think things may get a lot worse in the short term as we push through the period of adjustment.Dunners wrote: ↑Sun Sep 10, 2023 5:34 pm ...a large chunk of this crowd have been buying houses that give the best yields, which tend to be of the type (and in locations) that are not seen as desirable by owner occupiers. And if BTL is now seen as a sub-prime investment option, who are they going to sell to?

The big investment firms, which are looking at the UK rental market, are not interested in these properties either. They want large scale Build To Rent options on high-density blocks of flats. And many of their former tenants will be less likely to qualify for mortgage products.

-

Daily Express bot

- Tiresome troll

- Posts: 1468

- Joined: Sun Aug 13, 2023 5:26 am

- Has thanked: 733 times

- Been thanked: 114 times

Re: House selling prices

If the formally rented properties become occupied by the new owners and no longer a buy to let then of course the stock of properties available to rent decreases making the demand much higher and the price of the rents.Max Fowler wrote: ↑Mon Sep 11, 2023 9:47 amI'm not sure where I have attacked anyone? You sound like one of those think-skinned, touchy landlord types.Loin Cloth Lenny wrote: ↑Mon Sep 11, 2023 9:40 am

In answer to your question. The sold properties go to the general market. They are either owner occupied or bought and let as buy to let’s again. T

So we have confirmed that the houses/homes do still exist - thank God for that! That's the most important thing. As a Landlord having to sell up doesn't change the stock of houses, and obviously has no impact on the number of people in the country, supply of houses and demand for houses sounds as if it is exactly the same?

My Agent friend tells me he has up to 50 calls an hour as soon as a flat in Leyton and surrounding areas, goes live on Right Move . Many interested parties offer more than the asking rent to secure a flat which also pushes rent prices up.

Phone any Agency your self and see how many hurdles you have to jump over to even be considered for a viewing of an available property. It is quite alarming.

- Max Fowler

- Boardin' 24/7

- Posts: 5497

- Joined: Tue Mar 23, 2021 12:18 pm

- Has thanked: 509 times

- Been thanked: 1262 times

Re: House selling prices

So when the formally rented property is sold, the stock of homes to rent decreases by 1.Loin Cloth Lenny wrote: ↑Mon Sep 11, 2023 9:58 am

If the formally rented properties become occupied by the new owners and no longer a buy to let then of course the stock of properties available to rent decreases making the demand much higher and the price of the rents.

But equally, the amount of people now demanding a home to rent has also decreased by 1 as and additional person now owns their own home.

You haven't thought this through.

- Dunners

- Boardin' 24/7

- Posts: 9033

- Joined: Thu Apr 11, 2019 4:21 pm

- Has thanked: 1074 times

- Been thanked: 2497 times

Re: House selling prices

Happy Monday morning, everyone. Especially to BoniO. Here's the latest data on how the housing market is f*cked* and likely to get worse*.

*Depending on your perspective.

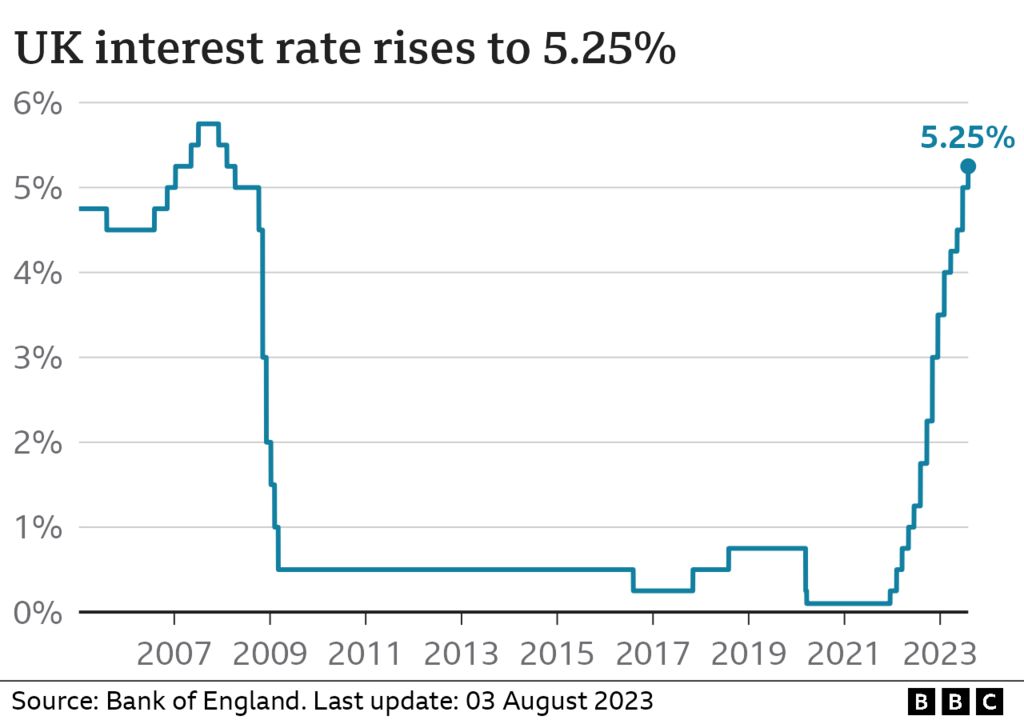

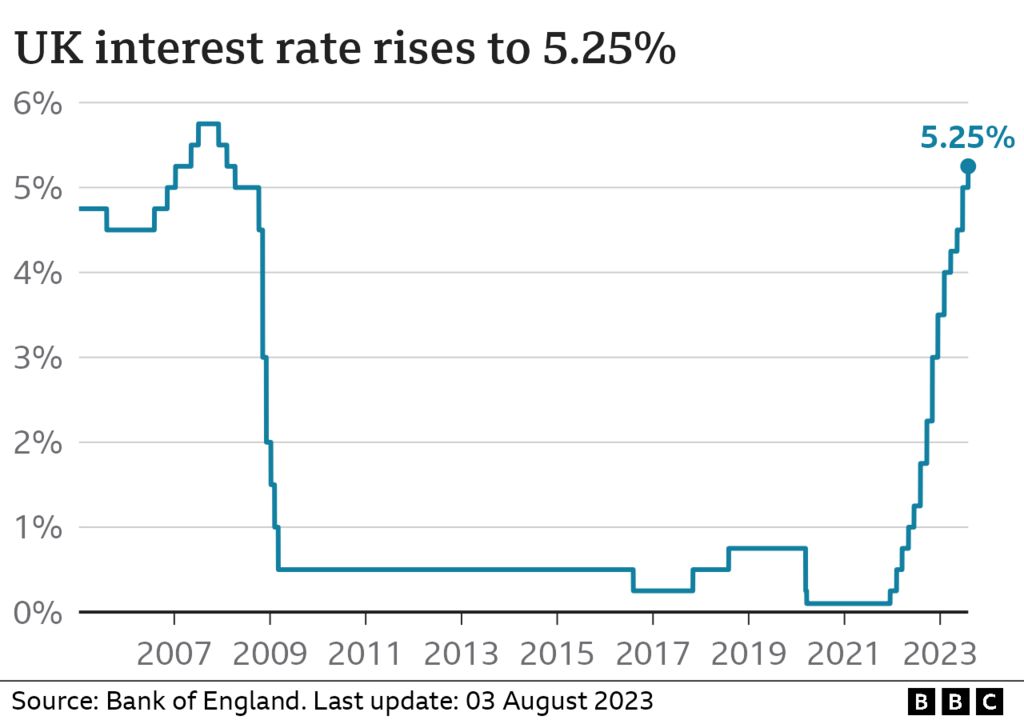

Bank of England has raised rates 14 times since December 2021, from 0.1% to 5.25%. These are predicted to peak c6%

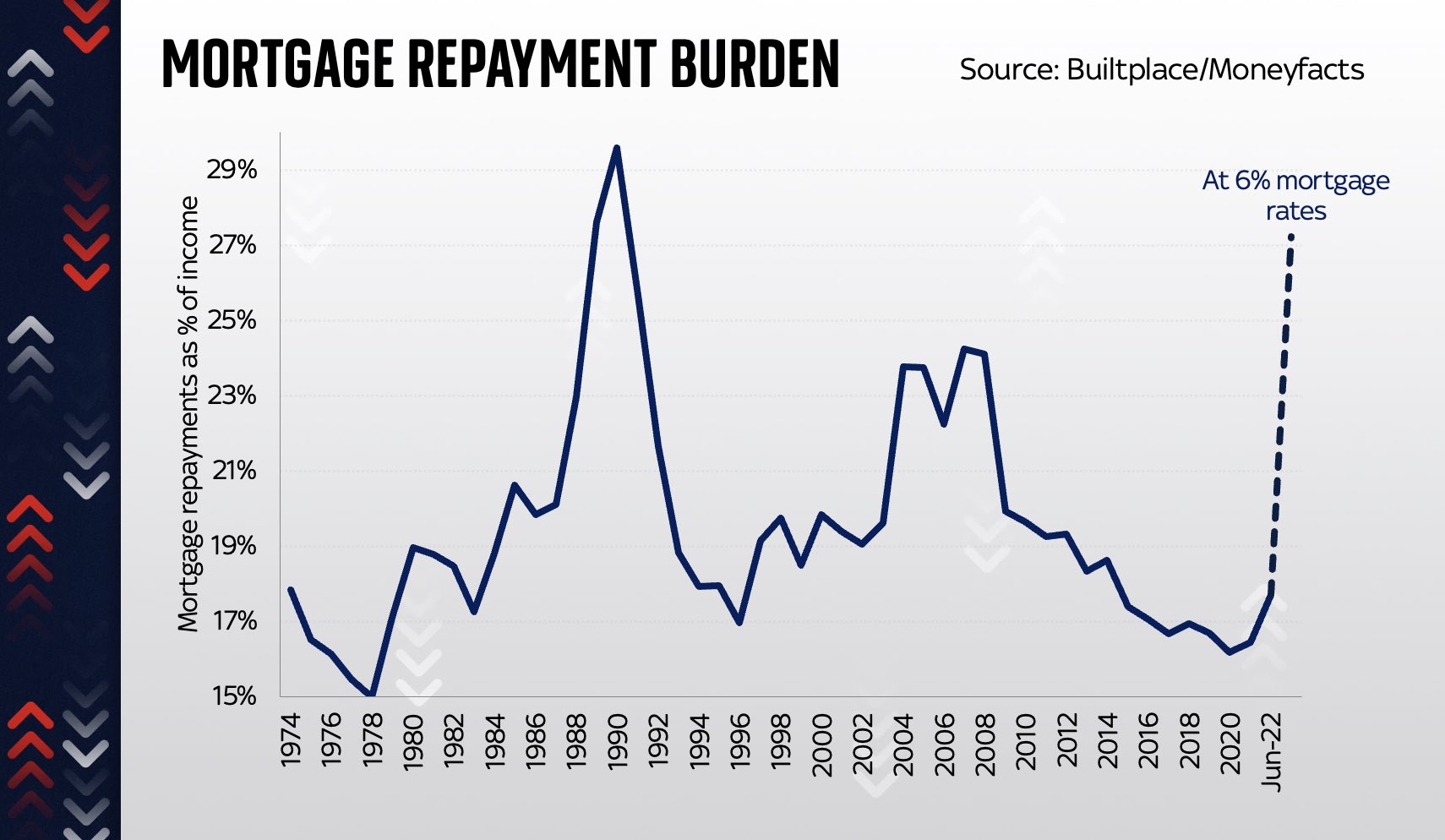

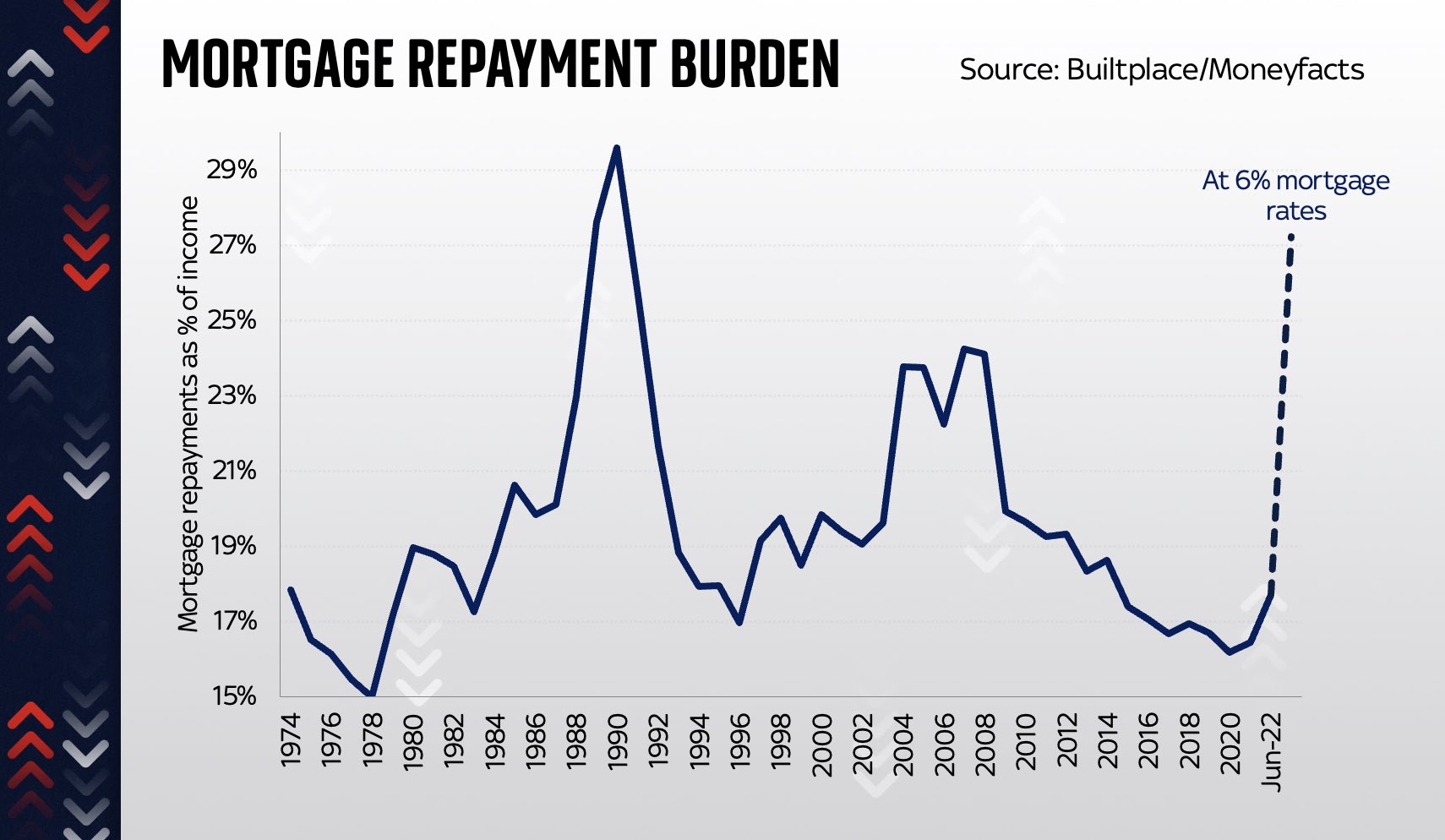

When adjusted for current levels of household borrowing, this will feel worse than double-digit rates in 1980. This is mainly because, during the above period of ultra-low rates, household borrowing has increased to record highs.

At 6%, this will represent 27% of a typical household income.

What will this mean for mortgaged homeowners?

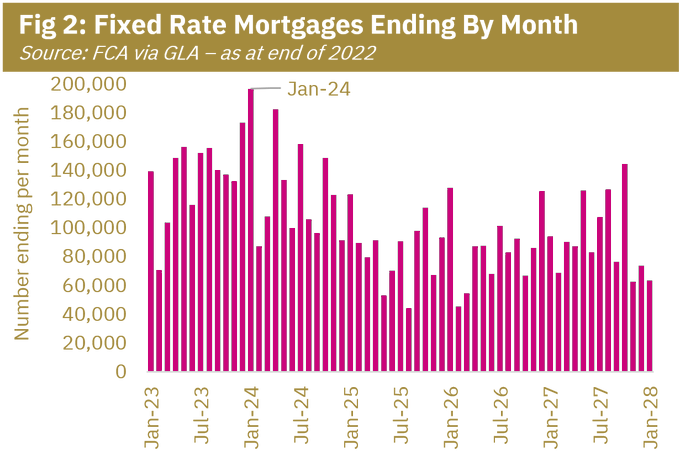

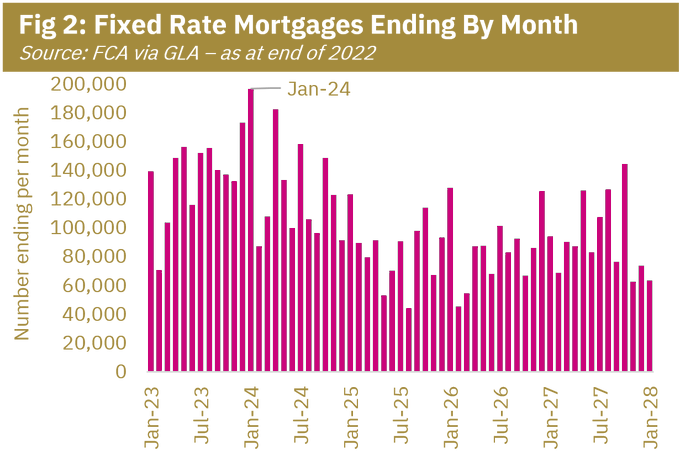

Most fixed-rate deals, expiring within the next 12 months, were set below 2%. Almost all were set below 2.5%

Average c100K households a month being hit with a significant increase in repayments.

1.6million fixed-rate mortgages were due to end this year. The peak will be in Dec 23/Jan24 when over 370,000 are due to end.

What is this doing to the sales market?

Compared to 2022 levels, Zoopla reports that:

Buyer demand is down 34%

Transactions are down 20%

Property supply is up 16%

This means that we're seeing a shift in the supply/demand dynamic. And the latest house price data supports this.

Nationwide has reported the fastest fall in prices since 2009, and the fall in August was double what was predicted.

Bank of England reports a 30% reduction in mortgage approvals since August 2022.

But all of this data is based upon market activity which will have commenced c6 months ago.

The volume housebuilders (Crest Nicholson, Barratts etc) are all reporting that off-plan new-build sales have ground to a halt. They're not issuing profit warnings just yet, but they are worried.

So could this mean a crash? Probably not.

The market is fairly resilient as the majority of privately owned and occupied homes do not have a mortgage. And the impact of rate rises is delayed due to the high proportion of mortgagees being on fixed-term deals. Instead, we're likely to see a "slide" in prices, which is expected to intensify in second half of the year and throughout 2024. Sub-2.5% fixed mortgage rates will continue to mature into 2025.

So, is this good news for private renters? No. At least, not for another few years.

BTL landlords are exiting the market. This is resulting in a severe shortage of residential lets, and likely to get worse before it gets better.

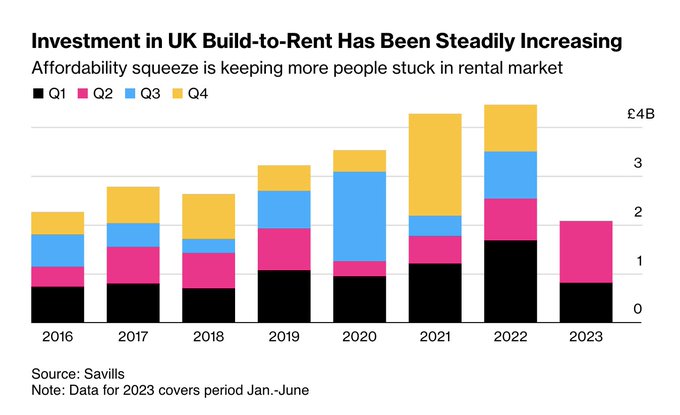

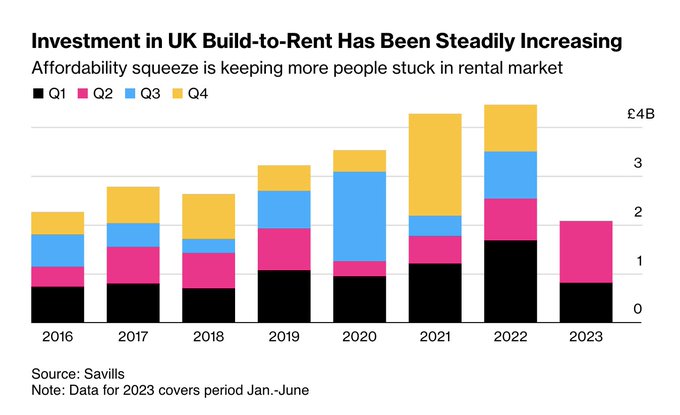

Government strategy is to replace BTL with Build to Rent. Build to Rent current accounts for 100K rental properties, and was expected to eventually account for 1.6million rentals (c30%), becoming the defacto rental solution for the UK housing market and providing renters with more stability.

Investment in UK Build-to Rent has been steadily increasing… until this year, which is so far -36% DOWN on 2022. We're not sure why this is, whether it is a blip that will recover, or the start of a new problem.

*Depending on your perspective.

Bank of England has raised rates 14 times since December 2021, from 0.1% to 5.25%. These are predicted to peak c6%

When adjusted for current levels of household borrowing, this will feel worse than double-digit rates in 1980. This is mainly because, during the above period of ultra-low rates, household borrowing has increased to record highs.

At 6%, this will represent 27% of a typical household income.

What will this mean for mortgaged homeowners?

Most fixed-rate deals, expiring within the next 12 months, were set below 2%. Almost all were set below 2.5%

Average c100K households a month being hit with a significant increase in repayments.

1.6million fixed-rate mortgages were due to end this year. The peak will be in Dec 23/Jan24 when over 370,000 are due to end.

What is this doing to the sales market?

Compared to 2022 levels, Zoopla reports that:

Buyer demand is down 34%

Transactions are down 20%

Property supply is up 16%

This means that we're seeing a shift in the supply/demand dynamic. And the latest house price data supports this.

Nationwide has reported the fastest fall in prices since 2009, and the fall in August was double what was predicted.

Bank of England reports a 30% reduction in mortgage approvals since August 2022.

But all of this data is based upon market activity which will have commenced c6 months ago.

The volume housebuilders (Crest Nicholson, Barratts etc) are all reporting that off-plan new-build sales have ground to a halt. They're not issuing profit warnings just yet, but they are worried.

So could this mean a crash? Probably not.

The market is fairly resilient as the majority of privately owned and occupied homes do not have a mortgage. And the impact of rate rises is delayed due to the high proportion of mortgagees being on fixed-term deals. Instead, we're likely to see a "slide" in prices, which is expected to intensify in second half of the year and throughout 2024. Sub-2.5% fixed mortgage rates will continue to mature into 2025.

So, is this good news for private renters? No. At least, not for another few years.

BTL landlords are exiting the market. This is resulting in a severe shortage of residential lets, and likely to get worse before it gets better.

Government strategy is to replace BTL with Build to Rent. Build to Rent current accounts for 100K rental properties, and was expected to eventually account for 1.6million rentals (c30%), becoming the defacto rental solution for the UK housing market and providing renters with more stability.

Investment in UK Build-to Rent has been steadily increasing… until this year, which is so far -36% DOWN on 2022. We're not sure why this is, whether it is a blip that will recover, or the start of a new problem.

- Max Fowler

- Boardin' 24/7

- Posts: 5497

- Joined: Tue Mar 23, 2021 12:18 pm

- Has thanked: 509 times

- Been thanked: 1262 times

Re: House selling prices

Top notch C&Ping, Dunnem.

But can you please explain this point:

"BTL landlords are exiting the market. This is resulting in a severe shortage of residential lets, and likely to get worse before it gets better."

Where are the properties going? Happy for you to put me right on this point in either your own words, or those of someone else.

But can you please explain this point:

"BTL landlords are exiting the market. This is resulting in a severe shortage of residential lets, and likely to get worse before it gets better."

Where are the properties going? Happy for you to put me right on this point in either your own words, or those of someone else.

- Max B Gold

- MB Legend

- Posts: 12332

- Joined: Thu Apr 11, 2019 2:12 pm

- Has thanked: 986 times

- Been thanked: 2806 times

Re: House selling prices

Don't these houses sold by the much despised BTL Brigade get sold to even bigger dirty, filthy, stinking greedy capitalists who covert them to HMOs and in effect create even more sub standard expensive housing.Max Fowler wrote: ↑Mon Sep 11, 2023 10:23 am Top notch C&Ping, Dunnem.

But can you please explain this point:

"BTL landlords are exiting the market. This is resulting in a severe shortage of residential lets, and likely to get worse before it gets better."

Where are the properties going? Happy for you to put me right on this point in either your own words, or those of someone else.

- Dunners

- Boardin' 24/7

- Posts: 9033

- Joined: Thu Apr 11, 2019 4:21 pm

- Has thanked: 1074 times

- Been thanked: 2497 times

Re: House selling prices

Heh.Max Fowler wrote: ↑Mon Sep 11, 2023 10:23 am Top notch C&Ping, Dunnem.

But can you please explain this point:

"BTL landlords are exiting the market. This is resulting in a severe shortage of residential lets, and likely to get worse before it gets better."

Where are the properties going? Happy for you to put me right on this point in either your own words, or those of someone else.

As I said above, this could self-correct over time, and result in better housing market conditions for renters. But there are lots of factors at play here that can result in the short term pain getting worse.

BTL investors looking to sell are now unlikely to sell to other BTL wannabes. So, if they are hoping to sell to prospective owner occupiers, then the following all could play a part:

- Rental properties being allowed to go vacant while the property is offered for sale (owner occupiers will be less inclined to commit to the purchase of a property if it has a sitting tenant)

- Rental properties, previously used as HMOs, being acquired by a single household resulting in a loss of a multi-occupancy unit

- Rental properties being listed for sale while vacant, but languishing on the market for an extended period of time as they are not in locations or the condition that is desirable to prospective owner occupiers.

That's a few, and probably some of the main ones, that could contribute to short-term pain for renters.

-

Proposition Joe

- Regular

- Posts: 4715

- Joined: Thu Apr 11, 2019 8:48 pm

- Has thanked: 2068 times

- Been thanked: 1694 times

Re: House selling prices

I know you've posted similar here before, Dunnem, but it still blows my mind that the *majority* of homeowners are mortgage free.

-

Adz

- Bored office worker

- Posts: 2595

- Joined: Fri Apr 12, 2019 10:15 am

- Has thanked: 106 times

- Been thanked: 627 times

Re: House selling prices

The part you are missing is immigration. If the population was staying the same it's a zero sum game, but immigrants tend to rent first so it adds to the pool of renters quicker than it is depleted by renters becoming ownersMax Fowler wrote: ↑Mon Sep 11, 2023 10:23 am Top notch C&Ping, Dunnem.

But can you please explain this point:

"BTL landlords are exiting the market. This is resulting in a severe shortage of residential lets, and likely to get worse before it gets better."

Where are the properties going? Happy for you to put me right on this point in either your own words, or those of someone else.